Meet Nicole Rueth Branch Manager, SVP theruethteam.com In the YouTube video, Nicole Rueth from the…

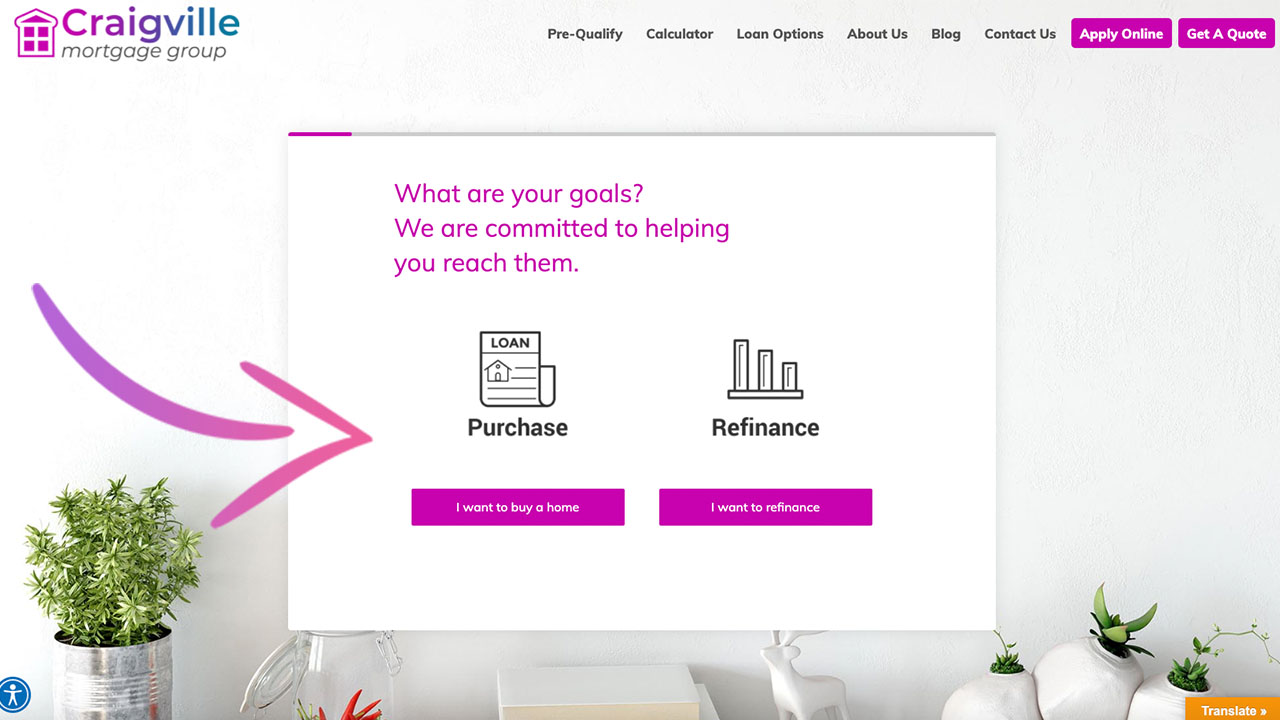

Most landing page elements give visitors information the moment they arrive on a page in a bid to keep them glued.

- The title tells them about the products’ unique selling proposition.

- The content gives them more information about the product and the benefits they can accrue from it.

- Customers’ badges and testimonials act as social proof that the product works.

- The videos and images show them how to use the product.

- And the Call to Action (CTA) tells them what next to expect.

Landing page forms take a different approach. Instead of giving, they take something from visitors—their details. This characteristic and the fact that landing page forms may require the entry of too much data may make visitors less enthused about them, thus causing them to abandon the page.

So how do you avoid this? Simply shift to using multi-step lead forms. These forms collect visitors’ details without intimidating them. As such, it makes them feel comfortable. Below we’ll look at what a multi-step lead form is and how it can increase conversions. Let’s dive in.

What is a multi-step lead form?

Just like its name suggests, a multi-step lead form is a long form that is broken down into multiple sections. These forms are used to make long forms such as registration and mortgage loan application forms less daunting. By enabling customers and leads to complete their details in smaller chunks, you create a better user experience and improve conversion rates.

According to a report by Formstack researchers, multi-step forms have a conversion rate of 13.9% compared to single forms with a conversion rate of 4.5%. No wonder multi-step lead forms are prominent in industries like financial services and mortgage lead generation.

What are the reasons why you should ditch static forms for multi-step forms?

The issue with static forms is that when visitors land on your page and see the multiple fields they are required to fill, they may get intimidated and abandon your page, especially if the reward isn’t motivating enough. Breaking the data into smaller digestible chunks eases the perceived burden. As such, it makes filling out the forms less overwhelming for your website visitors.

Below are some of the instances when mortgage and loan officers can use multi-step lead forms:

- When you want to obtain all the information you need to qualify leads without leaving any fields out

- When you want to qualify leads without intimidating website visitors with large chunks of information, that could end up diminishing your conversion rates

- When you want to identify visitors who are interested in your mortgage or loan financing services so that you can convert them

How can you optimize your multi-step form to increase conversion rates?

For your multi-step lead form to be successful, it needs to be fully optimized. Below are some tips for optimizing your multi-step lead form.

1. As a thumb rule, always start with the most critical information

You should always capture the essential information first. This data should be that which you need to qualify leads even if they abandon your page. Such data includes pain points, challenges, contact information, and why they need a mortgage or loan. You can further optimize your multiform by making the information that is less crucial optional.

2. Ensure that you use clickable buttons

Clickable buttons are convenient given that they enable visitors to proceed to the next view by simply clicking or tapping on the options provided. As such, it not only makes the forms more accessible but also speeds up the process of completing the forms. Using clickable buttons reduces the amount of typing needed, thereby making the forms mobile-friendly.

3. Make visitor progress visible

One way of ensuring that potential leads do not abandon your forms halfway through is ensuring that they can see their progress when completing the forms. Among the ways you can relay their progress as they fill out the form include:

- Use of progress bars.

- Use of percentages, i.e., 50% done.

- Showing the step they are on. For instance, you are on step 3/5.

This tact can be beneficial when the visitor is pressed for time since it will show them how far they are from completing the form.

4. Keep it simple

The golden rule of optimizing a multi-step form is not asking more than two questions per step and keeping the number of steps as low as possible. In scenarios where you can’t limit the number of fields, it would be prudent to group similar questions into one category. In a nutshell, don’t overdo things.

5. Ensure that the form provides a clear value

However much your form is optimized with multiple pages, if what you are offering isn’t of any value to your audience, your conversion chances are minimal at best. To convert your visitors to leads, what you are offering must be of value to them. And it needs to be something they receive immediately. Let’s say an immediate mortgage loan at friendly interest rates.

6. Ensure that you act on the requests on your visitors’ forms promptly

After the visitors have completed the forms, ensure that your sales teams act on their requests promptly. This is one area that most businesses perform dismally in. According to a Harvard Business Review study, the average response time is 42 hours, and only 37% of the companies responded to their leads within an hour.

Ensure that you respond to customer inquiries promptly, be it questions about the loan or mortgage terms, interest rates, or any other questions.

What are the benefits of using multi-step lead forms?

The mortgage industry is among those with the stiffest competition. As such, you need to consistently market your firm and generate leads if you want to be at the top of the food chain. Using multi-step lead forms on your landing page form is among the best ways of achieving that feat. Among the benefits of using multi-step forms include:

- You have a higher chance of generating leads with them so long as you use the pointers above to optimize them.

- The relevant information you get from them will help you secure quality leads.

- They are more visually appealing than single-step forms. As such, they have a lower abandonment rate.

- They reduce cognitive overload on visitors, given that they are divided into smaller chunks.

- They are also user-centric and save space on your website.

Are you a mortgage firm looking to better its lead generation efforts? Vonk Digital can help you do just that. We will ensure that you get found, build more trust with prospects, and convert leads into clients. Schedule a demo today to get a taste of our services.