People want to be able to do their own research on everything these days. The…

As more people look for mortgage information online, it’s important for your website to attract and keep potential customers. This article will give you tips and strategies to improve your mortgage website and turn visitors into valuable leads. But before you dive in watch this short video where we explain the process in which you can incorporate your mortgage website into your marketing.

Why Convert Visitors to Leads?

Conversion rates are important for measuring marketing effectiveness and generating potential clients for your mortgage business. Converting visitors into leads on your mortgage website is crucial for your business to succeed and grow.

If you have a high visitor-to-lead conversion rate, it means your marketing channels are working well. It also shows that your website is interesting enough to turn visitors into leads. It shows that your content, design, and user experience are resonating with your target audience, prompting them to take action.

Mortgage professionals can create a strong sales funnel by converting visitors into leads. This helps them have a steady flow of potential clients. Qualified leads are more likely to interact with your sales team and consider your mortgage products. They could become paying customers. Converting visitors into leads increases revenue and builds your industry’s reputation.

To increase the number of visitors who become leads, try optimizing your website for search engines. Create engaging content, like blog posts and educational resources. Offer valuable tools, such as a mortgage calculator or rate quote. Use progressive forms to collect contact information from potential borrowers. Additionally, positive online reviews and a user-friendly mobile experience can further enhance your conversion rates.

In short, it’s important to convert website visitors into leads on your mortgage site. This helps measure how well marketing works, find new clients, and make sure the business grows. You can build a successful lead generation machine for your mortgage business by using different strategies to attract and convert visitors into leads.

We have also been heavily reccommending that our clients create some sort of “lead magnet” they can offer on thir site in exchnage for contact info. Offer somethign better than a home buyers guide if possible though as that is not compelling. Create a short video explaining something important or give away a tool you use for yourself. The strategy here is that you can use this giveaway as a way to start a relationship with someone by helping them in advance and then earn their trust through various follow up.

Here is an example of a lead magnet we have for you…

Understanding Your Visitors

To convert visitors into leads on your mortgage website, you must understand your target audience well. You can make your website content and user experience better by understanding what your users want and need. Use Google Analytics to collect data on your visitors, such as their demographics, site journey, and popular pages. By using this information, you can find patterns and trends. Then, you can create personalized messages for your customers. By understanding your visitors and what drives them to take action, you can optimize your website to generate high-quality leads and maximize your conversion rates.

Identifying Your Target Audience

Identifying Your Target Audience for Converting Visitors to Leads on Your Mortgage Website

Converting website visitors into leads is an essential step for any mortgage professional looking to grow their business online. To increase your chances of success, it’s crucial to identify and target the right audience for maximum engagement. Here are some steps to help you determine your target audience:

- Define your specialty: Determine your area of expertise within the mortgage industry. If you know your specialty, like VA loans or loan refinancing, you can customize your content and marketing.

- Research and gather data: Conduct market research to identify the specific audience interested in your specialty. You can learn about your website visitors with Google Analytics. It tells you their demographics, interests, and online behavior. This data will help you create buyer personas and better understand your target audience’s preferences and pain points.

- Create a survey: Engage with your audience through social media by creating a survey that seeks their opinions and needs. To improve your messaging and offerings, get feedback from potential clients and understand their needs.

- Interact and engage: Actively participate in blog comments, social media posts, and forums relevant to your mortgage specialty. Engaging with potential customers allows you to build relationships, establish yourself as a trusted expert, and gain valuable feedback from your target audience.

- Implement email campaigns: Make good use of your contact form or email address on your website to capture potential leads. Send informative email campaigns with educational content, updates, and personalized offers. This will keep your audience interested in your mortgage products.

To get more customers for your mortgage website, figure out who your ideal customers are and use marketing strategies that reach them. This will help you get more high-quality leads and increase your conversion rates.

Evaluating Your Website Traffic Sources

It’s important for mortgage professionals to turn website visitors into leads to grow their online business. To maximize this conversion process, it is essential to evaluate your website traffic sources. By understanding which channels are most effective in attracting visitors, you can focus your efforts and resources for optimal results.

One valuable tool for analyzing website traffic is Google Analytics. This platform shows how well your website is doing, like which sources bring in the most visitors and potential customers. By tracking and analyzing this data, you can identify the channels that are driving high-quality leads and allocate your marketing efforts accordingly.

When evaluating your traffic sources, it is important to consider both organic and paid traffic. Organic traffic means people find your website through search engines, while paid traffic promotes your website with ads. To increase the number of people visiting your website, optimize it for relevant keywords and track conversion rates. You can use Google Ads to attract people looking for mortgage information. You can choose specific keywords and bid on cost-per-click.

By evaluating your website traffic sources and focusing on the most effective channels, you can increase your chances of converting visitors into hungry leads. By using this strategy, you can focus your time and resources on areas that will have the most impact. This will help mortgage professionals grow their business.

Analyzing User Behavior on the Website

It’s important to analyze how users behave on your mortgage website. This helps convert visitors into leads who are interested. By using website analytics tools like Google Analytics, you can gain valuable insights into how users interact with your site and make informed decisions to drive conversions.

One important metric to track is page views. Monitoring the number of page views can give you an idea of which pages on your website are more popular and engaging for visitors. This information can help you optimize your content or design to better capture their interest.

Another important metric is the bounce rate. This represents the percentage of users who leave your website without taking any action. A high bounce rate indicates that visitors are not finding what they are looking for or are not engaged with your content. By identifying pages with high bounce rates, you can make improvements to keep visitors on your site and encourage them to explore further.

Tracking the average time on page can provide insights into how users are engaging with your content. When visitors spend more time on your page, it means they find your content valuable. This makes it more likely that they will become leads. Conversely, a low average time on page may signal that your content needs improvement or is not meeting visitor expectations.

To effectively analyze user behavior, it is important to set goals and track conversions. This could include actions such as filling out a contact form, signing up for a newsletter, or clicking on a call-to-action button. By tracking these conversions, you can measure the effectiveness of your website in turning visitors into leads.

By studying how users behave on your mortgage website, you can use data to make better decisions and improve your site’s lead conversion. Utilize website analytics tools like Google Analytics to understand your users and tailor your website to their needs and preferences.

Conversions & Conversion Rates

The conversion rate is important for mortgage professionals. It shows how well they turn visitors into leads. In a highly competitive industry like mortgage lending, a high conversion rate can be the difference between success and stagnation. Mortgage professionals can attract more customers by understanding what motivates them to act. They can then use strategies to convert these customers into leads, which will help their business grow.

The conversion rate is the percentage of website visitors who complete a desired action. This includes filling out a contact form or providing their email address. It is a crucial marketing metric that indicates the efficiency of turning potential borrowers into leads. A high conversion rate means a mortgage website gives useful information, engages the audience, and captures their interest. Conversely, a low conversion rate suggests that there may be barriers to or missed opportunities in the lead generation process. Mortgage professionals can improve their online presence and attract more leads by analyzing conversion rates. This can help boost their business growth.

Strategies for Converting Visitors to Leads

Any mortgage professional who wants to grow their business needs to turn website visitors into leads. By using smart strategies, mortgage professionals can make their website a machine for getting new leads. A good strategy is to offer helpful content that teaches and interests potential customers. Mortgage professionals can demonstrate expertise and appeal to borrowers by creating blog posts, calculators, or videos. When gathering information from visitors, start by asking for their basic contact details. Then, ask for more specific information later on.

Making call-to-action buttons stand out and enhancing the contact form can also result in higher conversion rates. One more way to get more people to visit your website naturally is to use search engine optimization (SEO). Mortgage professionals can make their website more visible to people who are actively searching for mortgage solutions by optimizing keywords and meta tags and putting in place a content marketing plan.

To attract more mobile users, it’s crucial to make the mobile experience seamless and fast. This can be done through responsive design and fast loading times. Lastly, receiving positive online reviews, demonstrating mortgage professionals’ expertise, and delivering excellent customer service can further enhance the conversion process. By using these strategies, mortgage professionals can convert website visitors into valuable leads. This will ultimately contribute to the growth of their business.

Optimize Search Engine Results

Mortgage professionals need to optimize search engine results to help convert visitors into leads. Mortgage professionals can improve their visibility to potential clients by using effective SEO strategies. These strategies help them achieve higher rankings on search engine results pages.

In order to boost your search engine rankings, you must create unique and valuable content that appeals to your intended audience. This could include blog posts, educational articles, and informative guides about mortgage industry trends, loan programs, and mortgage products. By offering valuable content, visitors are more likely to engage with your site and become interested leads.

Additionally, optimizing page titles and descriptions with relevant keywords and phrases can further improve search engine rankings. This will make it easier for search engines to understand the content of the page and match it with user search queries. Internal linking to relevant pages within your website, as well as incorporating backlinks from reputable sources, can also signal to search engines that your website is authoritative and trustworthy.

Creating a Google Business Profile is another effective way to optimize search engine results. By providing accurate and up-to-date information about your mortgage business, such as your contact information, location, and services, you are more likely to appear in local search results.

Create Engaging Content and Blog Posts

Creating interesting content and blog posts for your mortgage website is important to turn visitors into leads. You can attract new clients, boost SEO, and establish credibility by offering valuable content.

Engaging content and blog posts serve as magnets, drawing potential clients to your mortgage website. By providing valuable insights, answering common questions, and addressing industry trends, you can capture the attention of potential borrowers who are actively seeking mortgage information.

Furthermore, regularly updated and relevant blog posts can boost your SEO efforts. By incorporating SEO keywords and phrases into your content, you can optimize your website for high search engine rankings. This makes it easier for potential clients to find your website when they search for mortgage-related topics.

In addition to attracting new clients and improving SEO, creating engaging content and blog posts also helps establish credibility. By showcasing your expertise and industry knowledge, you position yourself as a trusted resource. This builds trust with potential clients and increases the likelihood of them reaching out to you for their mortgage needs.

Implement a Lead Form on Your Site

One effective way to convert visitors into hungry leads on your mortgage website is by implementing a contact form. A contact form acts as a gateway for potential clients to reach out to you, expressing their interest in your mortgage services. It provides a convenient and user-friendly option for visitors to inquire about your offerings, request more information, or even schedule a consultation.

But why is a contact form so important in lead generation?

First and foremost, it eliminates barriers and friction that may deter potential clients from reaching out. To find your contact information easily, use a contact form instead of searching or navigating through pages. With just a few simple fields, visitors can quickly input their details and submit their inquiry, ensuring a smooth and seamless experience.

Moreover, a contact form allows you to collect vital information about your potential leads. You can collect valuable data by asking for their name, email address, phone number, and other details like loan preferences. This information helps you customize your sales approach for each person and follow up with personalized messages.

To make your contact form even more effective, consider implementing progressive forms. Progressive forms dynamically adapt to visitors based on their previous interactions, displaying only relevant fields. To prevent overwhelming potential leads, use shorter forms. This makes it more likely for them to finish. You can also add a mortgage calculator or rate quote option to the contact form. This will add immediate value and make visitors more interested.

To optimize your contact form for maximum lead generation, leverage the power of strong call-to-actions (CTAs). Encourage visitors to fill out the form with compelling and action-oriented language. Use phrases like “Get Started Today” or “Request a Free Consultation.”” Additionally, position your contact form strategically on your website, making it easily accessible and visible. Placing it on multiple pages, especially those with high traffic or where visitors typically show interest, can further enhance your chances of conversion.

Lastly, don’t forget to track and analyze the performance of your contact form. Utilize tools like Google Analytics to measure the number of form submissions, conversion rates, and any drop-off points. This data will give you insights into the effectiveness of your contact form and help identify areas for improvement.

Implementing a contact form on your mortgage website is a vital step in converting visitors into hungry leads. By simplifying the process, collecting valuable information, and optimizing for engagement, you can maximize your chances of capturing potential clients and turning them into loyal customers.

Utilize Google Ads and Other Online Advertising Platforms

Using Google Ads and other online ads can help turn website visitors into interested leads on your mortgage site.

With Google Ads, you can make ads that show up when people search for mortgage or loan options. You can make sure the right audience sees your ads at the right time by bidding on relevant keywords. This precision targeting increases the chances of attracting high-quality mortgage leads who are actively searching for loan options.

What sets Google Ads apart is its ability to track and measure the performance of your ads. With detailed analytics, you can see how many clicks and conversions your ads generate, giving you valuable insights into the effectiveness of your advertising campaigns. This data allows you to optimize your ads, refine your targeting, and ultimately improve your conversion rates.

To boost your lead generation, use social media ads and local advertising platforms, along with Google Ads. Facebook and Instagram have powerful targeting options. They let you reach specific demographic groups or target audiences interested in homes, real estate, or mortgages. This level of precision targeting helps you engage with potential borrowers who are more likely to be interested in your mortgage services.

You can also use local directories or community websites to reach borrowers in your area. By placing ads on platforms that cater to local communities, you can increase your visibility among potential clients in your target market.

By using Google Ads and other online ads, you can get good mortgage leads and turn website visitors into interested clients.

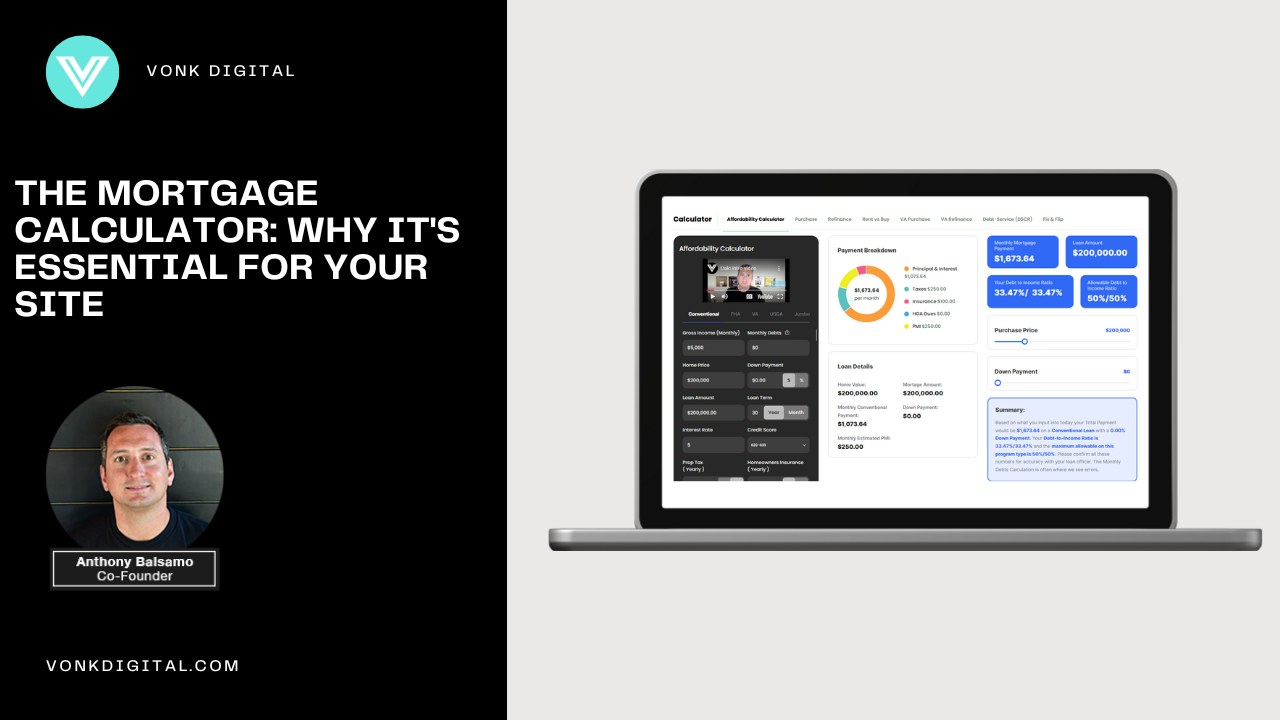

Offer Mortgage Calculators and Tools

Having mortgage calculators and tools on your website is vital for turning visitors into potential leads. These tools provide immediate feedback and answers to prospective buyers, preventing them from leaving your website to find information elsewhere.

By including mortgage calculators, you give potential clients the ability to estimate their monthly payments, determine affordability, and explore different loan options. These tools not only provide valuable information, but they also create a sense of trust and credibility for your business.

Mortgage calculators can help visitors qualify for a mortgage on your platform. Users can enter their financial information and quickly find out if they qualify for a mortgage loan. When you provide this service, you collect important contact information from potential leads. This helps your sales team follow up and nurture their interest.

In addition to mortgage pre-qualification tools, interactive calculators for refinancing, interest rates, and affordability can also be integrated into your website. These tools empower prospective buyers to make informed decisions and explore different scenarios. By providing these valuable resources, you keep visitors engaged on your site, increasing the likelihood of converting them into hungry leads.

Improving Lead Quality Through Automation

To be successful in the mortgage business, you need to turn website visitors into qualified leads. It’s important for people who work in mortgage lending to get good leads, not just any leads. One effective way to do this is to use lead generation automation tools and strategies. Mortgage professionals can streamline their lead generation, boost efficiency, and ultimately improve the quality of leads by automating some tasks.

Using progressive contact forms on your website is a key part of automation. To keep potential borrowers from getting too stressed out, a progressive form breaks the contact form up into steps that are easy to handle. This not only makes the experience better for the user, but it also helps the mortgage professional learn more specific and useful details about the lead. This information can be used to sort and qualify leads so that the sales team can focus on the best candidates.

Scores for leads are another important automation tool. Mortgage professionals can decide which leads to follow up on first by giving each one a numerical value based on their actions and other characteristics. Leads who show signs of being more interested or ready to engage can be sent straight to the sales team. Leads who need more nurturing can be put into automated email campaigns or targeted marketing campaigns.

Along with automation, mortgage professionals can use content marketing to find new leads and keep in touch with them. Professionals can get new clients by writing informative articles about common questions and issues in the mortgage industry. They can make themselves look like experts by writing blog posts, articles, or videos. Visitors to your website can become leads by subscribing to your newsletter or getting their contact information in exchange for useful resources.

To improve leads, create an automated plan with content marketing, lead scoring, targeted lead generation, and progressive forms. Mortgage professionals can make their websites generate leads by using these strategies correctly. This will bring in and convert high-quality leads that are more likely to become happy clients.

Utilizing Automated Email Sequences

Using automated email sequences is a powerful tactic for mortgage professionals who want to turn website visitors into potential leads. Professionals can use this approach to keep in touch with potential clients and build relationships. It can also help them generate repeat and referral business.

Consistent email communication is crucial to maintaining top-of-mind awareness among prospects. By regularly sending targeted emails to those who have expressed interest, mortgage professionals can build trust and keep their services at the forefront of clients’ minds.

Implementing a data-driven mortgage marketing strategy is essential for success. By utilizing a mortgage CRM platform, professionals can segment their contact list and tailor email content to specific audience groups. This lets you send personalized messages to make sure people get the relevant information they want.

Automation tools like Constant Contact make managing email campaigns seamless and efficient. They offer ready-made templates, scheduling choices, and analytics to track open and click rates. Professionals can use these insights to improve their email strategy and better communicate with clients.

Mortgage professionals can use automated email sequences to convert website visitors into leads. They can also build long-term relationships. This plan brings more customers and helps professionals appear trustworthy, attracting new clients.

FAQ

How to get clients for mortgage online?

To attract online mortgage clients, create a user-friendly, professional website with helpful content. Utilize search engine optimization (SEO) to improve visibility, engage in online advertising, and maintain active social media profiles to build trust and educate potential clients.

Where do mortgage companies get their leads from?

Mortgage companies often obtain leads from various sources including online advertising, SEO, referrals from past clients, partnerships with real estate agents, and lead generation platforms that specialize in the mortgage industry.

How can I get more leads for my mortgage?

Increasing mortgage leads can be achieved through a mix of online and offline strategies. Online, optimize your website for search engines, engage in pay-per-click advertising, and nurture relationships on social media. Offline, network with real estate professionals, host educational seminars, and ask satisfied clients for referrals.

Conclusion

Discover effective marketing techniques to transform visitors into leads on your mortgage website. Using these techniques can help you generate more leads on your mortgage website and turn visitors into valuable leads. This leads to business growth and success in the competitive mortgage industry.