People want to be able to do their own research on everything these days. The…

Do you want to make your mortgage website more credible and become an industry expert? Building online authority through compelling and valuable content is the key. In this blog post, we’ll look at ways to create and publish engaging content. This will help you gain online authority and attract potential clients to your mortgage website.

What is Online Authority, Anyway?

Online authority is crucial for mortgage businesses and professionals. It shows expertise, credibility, and influence, which leads to trust, visibility, and leads. Consistently providing valuable content builds trust. Blog posts and social media boost visibility. Reviews and testimonials increase authority and attract potential clients.

Benefits of Building Your Mortgage Website’s Online Authority

To build trust and credibility and attract qualified leads, you need online authority for your mortgage website. It also helps increase visibility. By creating valuable and informative content, you position yourself as an industry expert and gain the trust of potential customers.

Having a strong online authority helps establish trust and credibility with your target audience. When visitors see that you are knowledgeable and provide helpful content, they are more likely to perceive you as a reliable source. This trust can lead to increased conversions and customer loyalty.

Furthermore, building online authority improves your visibility in search engine rankings. When you consistently produce high-quality content, search engines recognize your website as a valuable resource. This helps your website rank higher in search results and be seen by more potential customers looking for mortgage information.

In addition to trust and visibility, building authority on your mortgage website allows you to attract qualified leads. When you establish yourself as an industry expert, potential customers are more likely to seek out your services. They are confident in your abilities and are more inclined to choose you over your competitors.

In conclusion, building online authority for your mortgage website is crucial. It not only establishes trust and credibility but also increases your visibility and attracts qualified leads. When you consistently create useful content, you become an industry expert. This helps you gain the trust of your target audience and build loyal customers.

Understanding Your Target Audience

To build online authority with content on your mortgage website, it is crucial to have a deep understanding of your target audience. By knowing who your potential customers are, their needs, and pain points, you can tailor your content to provide the most relevant and valuable information. When you personalize your approach, it shows you’re an expert and understand your clients’ needs.

When creating content, consider your target market’s demographics, such as age, income level, and location. Consider the difficulties they might have with mortgages. This could include first-time homebuyers who need help or experienced investors looking for refinancing information. By addressing these pain points directly and offering solutions, you become a trusted resource that potential customers can rely on.

In addition, consider their preferred communication channels and platforms. Are they active on social media platforms like Facebook or LinkedIn? Do they prefer consuming content through blog posts or videos? Understanding these preferences allows you to deliver content in the formats and channels that resonate most with your target audience, increasing their engagement and establishing your authority.

To effectively reach your target audience, understand them deeply. This way, you can create content that is relevant and informative. This will help establish your authority online and attract qualified leads in the mortgage industry.

Identifying Your Target Market

To establish credibility on your mortgage website, find and focus on your specific audience. By understanding the specific needs and pain points of your target market, you can create tailored content that resonates with them and positions you as a trusted authority in the industry.

Start by identifying your niche audience and their unique use-case opportunities. You can focus on helping first-time homebuyers with the mortgage process. You can also assist self-employed individuals with specialized loan programs. By narrowing down your target market, you can create specific service pages on your website that address their needs directly.

In addition to targeting a niche audience, it’s important to consider local audience targeting. Create niche location pages on your website that cater to potential clients in specific areas. You can improve your content for local searches and attract customers looking for mortgages in their area.

To further boost your online authority, leverage Google My Business. Create and optimize your business listing with accurate information, including your location, contact details, and a description of your services. This will help potential clients find you on Google Maps and enhance your visibility in local search engine results.

To establish authority on your mortgage website, know your target market and their specific needs. To attract clients in certain areas, become a trusted expert in mortgages. Make special web pages, target local people, and improve your Google My Business listing.

Creating Content That Engages Your Target Audience

To build authority in the mortgage industry, it’s important to create engaging content for your target audience. By offering value and addressing their specific needs and interests, you establish yourself as a trusted and knowledgeable resource.

When visitors come to your mortgage website, they are looking for information and solutions. By providing content that is informative, helpful, and tailored to your target audience, you not only capture their attention but also position yourself as an authority in the industry.

Engaging content helps attract and retain potential customers. When they find valuable information on your website, they are more likely to return and explore more of what you have to offer. By consistently providing helpful and informative content, you build trust and establish yourself as a reliable source for mortgage-related information.

To create engaging content, start by understanding your target audience’s specific needs, pain points, and interests. Conduct market research and gather insights to inform your content strategy. Use language that resonates with your audience, and focus on addressing their concerns and providing actionable solutions.

To show your expertise in mortgages, engage your audience with valuable content. This helps attract potential customers and build lasting relationships.

Developing a Digital Marketing Strategy for Your Mortgage Website

In today’s competitive mortgage industry, building online authority through your website is crucial. By establishing yourself as a trusted source of information, you can attract potential customers and differentiate yourself from the competition. To do this well, you need a digital marketing plan that focuses on creating valuable content.

Start by defining your target audience and understanding their specific needs and pain points. Conduct market research to gain insights into their preferences and behaviors. Use this information to tailor your content to address their concerns and provide practical solutions. By consistently publishing high-quality and informative content, you can establish yourself as an authority in the mortgage industry.

Using SEO techniques will make your website rank higher in search results, attracting more visitors. Optimize your website for relevant keywords and regularly update your content to stay relevant and demonstrate your expertise. Utilize social media platforms to promote your content and engage with your audience.

Remember, building online authority takes time and effort. Continuously monitor and analyze your digital marketing performance using tools like Google Analytics. By regularly evaluating your strategy and making adjustments as needed, you can effectively build and maintain your authority online, attract valuable leads, and grow your mortgage business.

Utilizing Social Media Platforms to Reach Potential Clients

To attract clients and stand out, mortgage professionals need valuable content on their website. However, creating informative content alone isn’t enough. To maximize your reach and establish yourself as an expert, you need to utilize social media platforms to connect with a wider audience and generate leads.

Mortgage professionals can use social media platforms to find clients and establish expertise. On Facebook, you can share informative posts and engage with your audience. You can also run targeted ads to generate leads.

YouTube is a platform that focuses on videos. You can use it to show your expertise by making tutorials, having Q&A sessions, and creating educational videos. It has a lot of users and good search engine ranking potential, so you can reach a large audience and become a respected leader in the mortgage industry.

Instagram is popular with young people because it focuses on visuals. You can use it to show off your mortgage services, success stories, and client testimonials with pictures and captions.

TikTok is popular for its short and creative videos. It lets you connect with a younger audience and show your industry knowledge in a fun and relatable way.

LinkedIn is a platform where you can connect with professionals and showcase your expertise through articles. It also helps you reach out to potential clients.

Mortgage professionals can use social media to find clients, show their expertise, and get leads. When creating content, adapt it for each platform and connect with your audience. Also, always offer valuable information to build trust and credibility.

Optimizing Search Engines for Increased Visibility

Mortgage professionals need to optimize for search engines to be seen as industry authorities. By implementing effective SEO strategies, you can improve your website’s ranking in search engine results pages (SERPs) and attract organic traffic.

SEO is about making sure search engines understand how important and valuable your content is. This is done by optimizing different parts of your webpage. Title tags, meta descriptions, H1 header tags, proper URL structure, formatted content, alt tags, embedded videos, and internal linking are all essential elements to consider.

Title tags should accurately summarize the content of each page while incorporating relevant keywords. Meta descriptions provide a brief overview of the page’s content, enticing users to click through. H1 header tags help search engines identify the main topic of each page.

Clear and descriptive URLs in a proper URL structure can help search engines understand your website. Well-formatted content that includes headers and bullet points not only makes it easier for readers to consume information but also helps search engines understand the page’s structure.

Alt tags for images provide alternative text that search engines can read, improving accessibility and helping with SEO. Embedded videos can enhance user engagement and SEO efforts by providing valuable content.

Internal linking, incorporating relevant hyperlinks within your content, helps search engines navigate and understand the relationships between your webpages.

Improving on-page SEO can make your website more visible in search results. It can also attract organic traffic and help you build authority as a mortgage professional online.

Leveraging Google My Business to Connect with Local Consumers

Leveraging Google My Business to Connect with Local Consumers

Using Google My Business (GMB) is important for mortgage websites. It helps them connect with local customers and appear more in local searches. With the majority of potential customers using search engines to find mortgage services in their area, having a well-optimized GMB page can make a significant difference.

To optimize a GMB page, start by ensuring that your contact information is accurate and consistent across all platforms. This will help potential customers easily find and contact your mortgage business. It’s also essential to regularly update your GMB page with recent information and high-quality photos, showcasing your services and creating a professional impression.

Encouraging past clients to leave reviews on your GMB page is another effective way to build authority online. Positive reviews not only enhance your visibility but also establish trust among potential customers. Responding to reviews, both positive and negative, shows that you value customer feedback and are committed to providing excellent service.

Mortgage websites can use Google My Business to connect with local consumers. They can also improve visibility in local searches and build authority in their target market. Don’t miss out on this valuable opportunity to establish your online presence and attract potential clients to your mortgage services.

Crafting Content that Informs and Educates Potential Customers

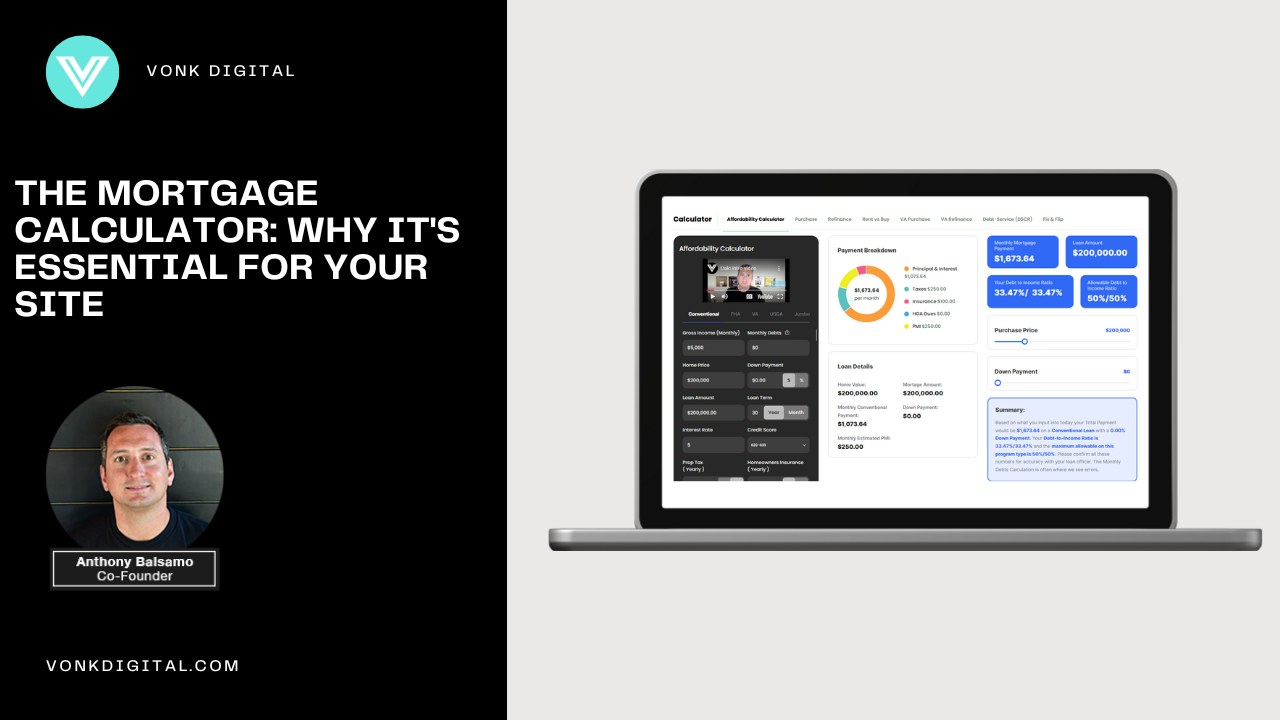

Building online authority is important for mortgage businesses. Content marketing on your website is essential. Create informative content about the mortgage process and loan programs. This will establish you as a trusted expert, building credibility and increasing search visibility. To establish authority, create a content strategy that meets your audience’s needs. Publish helpful blog posts, videos, and guides regularly. This will attract and engage potential customers, showing expertise and building trust in the mortgage industry.

Explain The Mortgage Process

The mortgage process can seem overwhelming, but with the right information, you can navigate it with confidence. One important thing to note is the Know Before You Owe mortgage disclosure rule, which simplifies the process and ensures transparency.

Under this rule, two new disclosure forms were introduced: the Loan Estimate and the Closing Disclosure. The Loan Estimate provides important details about your loan, such as the interest rate, monthly payments, and closing costs. It also includes information about any prepayment penalties or potential changes to your interest rate over time.

After finding the right lender and receiving a Loan Estimate, review the Closing Disclosure before closing. The Closing Disclosure outlines all the final terms and costs of your loan, including the loan amount, interest rate, and closing costs. It is essential to carefully review this document to ensure there are no surprises during the closing process.

To confidently navigate the process of buying a home, you need to understand mortgages and review disclosure forms. To establish your authority online, create valuable and informative content on your mortgage website. Make sure potential customers can easily find the information they need.

Highlighting Loan Programs and Options Available to Clients

When it comes to obtaining a mortgage, clients have a wide range of loan programs and options available to them. Understanding these choices is crucial to helping them make informed decisions about their mortgage.

One of the most common options is a conventional loan, which typically requires a higher credit score and a larger down payment. Conventional loans offer flexibility in terms of loan amounts and repayment periods.

The Federal Housing Administration-backed FHA loan is another popular option. First-time homebuyers or those with lower credit scores frequently seek out this type of loan. The main benefit of an FHA loan is that it requires a lower down payment compared to conventional loans.

For veterans and active-duty military personnel, a VA loan provides an attractive option. The Department of Veterans Affairs backs these loans, and they frequently have favorable terms like no down payment requirements and lower interest rates.

Lastly, there are USDA loans specifically designed for individuals looking to purchase homes in rural areas. These loans offer zero-down payment options and competitive interest rates.

Clients may have access to more programs and incentives in addition to these loan options. First-time homebuyer programs and down payment assistance are just a few examples of the resources that clients should explore.

You can help clients by showing them loan programs and options on your mortgage website. This will give them useful information to make informed decisions about their mortgage. You can establish your online authority by sharing information about various mortgage options. This will also help visitors establish their authority.

Writing Blog Posts, Social Media Posts, and Other Valuable Content

To gain trust and get customers, make valuable content for your mortgage website. This will help you stand out in a competitive industry. There are various forms of valuable content that mortgage professionals can create to engage and attract their target audience.

One effective form of content is writing blog posts. These articles can cover a wide range of topics related to the mortgage industry, such as mortgage rates, loan programs, the mortgage process, and tips for first-time homebuyers. By providing informative and helpful content, blog posts can position you as an expert and trusted resource in the industry. Optimizing blog posts can help your website’s search ranking, making it easier for clients to find you.

Social media posts are another valuable content medium to engage with your audience. You can use Facebook, Twitter, and LinkedIn to share posts and provide updates, news, and expertise. On social media, you can talk directly to customers and solve their problems. It’s a chance to show great customer service.

Other forms of valuable content include articles, videos, infographics, podcasts, and webinars. These diverse content formats allow you to cater to different learning preferences and engage with a wider audience.

To establish online authority, it is important to create valuable content, such as blog posts and social media posts. When you consistently share helpful information, you can attract clients, gain trust, and become a leader in your field.

Demonstrating Expertise with Data-Driven Insights and Analysis

To become an expert in the mortgage industry online, show expertise with data and analysis. Collecting and analyzing data can show your knowledge of the mortgage market and provide valuable insights.

To start, you can collect data from various sources in the mortgage industry. This can include loan application data, mortgage rates, market trends, and even customer feedback. By compiling and analyzing this data, you can identify patterns, trends, and opportunities that can help your potential clients make informed decisions.

By analyzing loan application data, you can find common challenges borrowers face and offer solutions. By monitoring mortgage rates and market trends, you can offer timely advice and recommendations to your audience.

To analyze the data well, use tools like spreadsheets, databases, or data visualization software. These tools can make it easier for your audience to understand and appreciate your insights.

By regularly sharing data-based insights and analysis on your mortgage website, you’ll establish yourself as an industry expert. This will also attract and engage potential clients who want valuable information to make informed decisions.

Using SEO Strategies to Increase Site Visibility and Ranking

One of the most important aspects of running a successful mortgage website is building online authority. You can achieve this by implementing SEO strategies in a strategic way. By optimizing your website for search engines, you can increase its visibility and improve its ranking, ultimately driving more qualified traffic to your site.

On-page SEO plays a pivotal role in boosting your website’s local SEO efforts. To improve your search ranking, make pages specific to your local audience. Additionally, ensuring that your Google My Business listing is accurate and up-to-date is crucial for local visibility. Implementing accurate schema markup on your website also enhances your chances of appearing in relevant search results.

Link building is another critical factor in building online authority. By obtaining high-quality backlinks from reputable sources, search engines perceive your website as more valuable and trustworthy. This can lead to higher search engine rankings and increased visibility.

Expanding your keyword strategy is equally important. Do thorough keyword research. Find terms and phrases that potential customers search for a lot. Incorporate these keywords naturally into your website’s content to improve its relevancy and increase the likelihood of appearing in search results.

To become an industry expert, consistently create valuable, informative, and engaging content. This can be achieved through blog posts, social media updates, and other forms of content marketing. To attract more visitors and gain online authority, establish yourself as a trustworthy source of information on your website.

Frequently Asked Questions

How do I market myself as an MLO?

To market yourself as an MLO, create an online presence through a professional website and social media profiles, network with real estate agents, and offer educational content like workshops or blogs on mortgage-related topics.

How do loan officers get customers?

Loan officers can acquire customers through referrals from previous clients, networking with real estate professionals, and maintaining an active online presence including client testimonials.

How do you get clients as a mortgage agent?

As a mortgage agent, obtaining clients can be achieved through cultivating strong relationships with local real estate agents, offering free educational seminars, and utilizing social media advertising to target potential homebuyers in your area.

Conclusion

To establish online authority, create valuable content, become a thought leader, and attract a loyal following. By consistently producing high-quality content and positioning yourself as a trusted source, you can increase your chances of appearing in search results and becoming an industry expert. This will not only enhance your online authority but also help you attract a loyal following who values your expertise and insights.