People want to be able to do their own research on everything these days. The…

It is crucial for businesses in all industries to have a strong online presence. For mortgage professionals, a well-designed website is not just a luxury, but a necessity. As more people use the internet, mortgage professionals need a website to build trust, get customers, and make connections. A website can show your expertise, give useful information to clients, and promote your services.

You can reach more people, including potential clients looking for mortgages in your area. Clients can contact you through a website using a contact form, email address, or phone number. Mortgage professionals can attract customers and improve visibility by investing in a modern website. This website should be user-friendly and streamline the mortgage process.

Having an Online Presence

Having an online presence is crucial for mortgage professionals in today’s digital age. It allows them to attract and serve clients more effectively, while also showcasing their services and building credibility. Here are a few key benefits of having an online presence as a mortgage professional:

- Attracting clients: With a website, mortgage professionals can reach a wider audience and increase their visibility. Potential clients can easily find them online through search engines or targeted advertising. This helps generate leads and attract clients who are actively searching for their services.

- Serving clients: An online presence allows mortgage professionals to provide valuable resources and information to their clients. Clients can learn about mortgages, rates, and products on their website. This helps clients make informed choices and establishes the mortgage professional as an industry expert.

- Showcasing services: A website provides mortgage professionals with a platform to showcase their services, previous client testimonials, and success stories. By doing this, you gain trust and credibility with potential clients looking for mortgage professionals. Mortgage professionals can stand out by showing their unique services and expertise.

- Capturing leads: Having a website with a contact form or a capture form allows mortgage professionals to collect the contact information of potential clients. This enables them to follow up with these leads and nurture them into becoming actual clients. Mortgage professionals can use email marketing and other tools to stay connected with leads. They can share valuable content regularly.

The Basics of Building a Website for Mortgage Professionals

Having a website is crucial for mortgage professionals in today’s digital age. Creating a website helps mortgage professionals gain visibility, credibility, and attract potential clients.

Choose the Right Platform

As a mortgage professional, having a website is essential in today’s digital age. Having a website helps establish an online presence, build credibility, and connect with potential clients. When it comes to choosing the right platform for your mortgage website, there are a few options to consider.

One popular choice is WordPress, a versatile and user-friendly platform that offers a wide range of features and benefits. You can fully control the design and function of your website using WordPress. This lets you customize it to meet your needs. You can easily customize themes and templates, integrate mortgage calculators, and create compelling content to attract and engage your target audience. WordPress also provides many plugins and tools to improve your website’s performance and make it more search engine friendly.

Alternatively, if you prefer a more simple and convenient solution, Wix is a hosted platform that can quickly get you up and running. With Wix, you can choose from a variety of pre-designed templates and easily customize them to match your branding. While Wix may offer less flexibility than WordPress, it makes up for it in terms of simplicity and ease of use.

No matter which platform you pick, a professional website helps you display your mortgage services. It also gives you the chance to give valuable information to possible clients and get leads through forms or email lists. It also allows you to establish and maintain client relationships by sharing compelling content and testimonials. Don’t miss out on the benefits of having an online presence; invest in a mortgage website today.

Design Your Website with User Experience in Mind

To attract and engage potential clients, it’s important to design your mortgage professional website with user experience in mind. A user-friendly navigation structure is key to ensuring that visitors can easily find the information they need. Organize your website in a logical manner, with clear and intuitive menus that guide users to different sections of your site.

Incorporate a clear call-to-action for interested leads to contact you. Place contact forms strategically throughout your website, making them easily accessible for visitors to request more information or start the application process. This allows you to capture potential client information and nurture leads.

By designing your mortgage professional website with user experience in mind, you create a seamless and enjoyable browsing experience for potential clients. This can lead to increased conversions and a steady stream of prospective clients for your mortgage business. Remember, a well-designed website with a user-centric approach is an essential tool for mortgage professionals in today’s digital age.

Customize Your Site to Fit Your Target Audience

When it comes to mortgage professionals, having a website is no longer a luxury but a necessity. In today’s digital age, potential clients expect mortgage brokers and loan officers to have an online presence. However, simply having a website is not enough. It is crucial to customize your site to fit your target audience in order to stand out from the competition and maximize your potential for success.

Understanding your niche and ideal audience is the first step in determining the customization options needed for your website. Consider factors such as the age, location, and financial goals of your target audience. By tailoring your site to their specific needs and preferences, you will create a more personalized and engaging user experience.

Showcasing your expertise and personality is another key aspect of building trust with your target audience. Use your website as a platform to share informative and compelling content that addresses their questions and concerns. Share your industry knowledge and insights on mortgages through blog posts, articles, or videos. Additionally, harness the power of social media to engage with your audience, share relevant content, and foster strong client relationships.

To attract customers, customize your website for your target audience and show your expertise. This will make you a trusted mortgage professional. Remember, an effective website is an essential tool in today’s competitive mortgage industry, allowing you to connect with your audience on a regular basis and grow your business.

Design Sales Funnels that Lead Prospective Clients to You

In the competitive mortgage industry, having a website is essential for mortgage professionals to attract and convert prospective clients. One powerful tool that can greatly enhance the effectiveness of a mortgage website is a well-designed sales funnel.

A sales funnel helps you attract potential clients, build relationships, and share important information. To attract potential customers, offer enticing lead magnets like a mortgage calculator or educational resources. They can enter their contact information. After getting their contact information, you can nurture the relationship by sending personalized emails. These emails should have valuable content, answer common questions, and showcase your expertise.

To ensure the effectiveness of your sales funnels, it’s important to track and analyze their performance. By utilizing tools like Google Analytics, you can gain insights into your website’s traffic sources, monitor conversions, and make data-driven decisions to optimize your sales funnels.

In the fast-paced mortgage industry, having a website is no longer enough to stand out. By implementing well-designed sales funnels, mortgage professionals can effectively lead prospective clients to their websites, nurture relationships, and ultimately convert more leads into customers.

Utilizing Email Marketing and Analytics to Maximize Reach

A website is like a virtual store that gives important information about your mortgage business. It also shows that you are knowledgeable and trustworthy. Mortgage professionals should use email marketing and analytics to reach more clients and generate leads.

Utilizing Email Marketing

Email marketing is a powerful tool for mortgage professionals to communicate with their target audience. Mortgage professionals can collect clients’ contact information from their website. This helps build an email list to send personalized messages and strengthen relationships. Mortgage professionals can use email campaigns to share helpful information, answer questions, and show their expertise. This shows their dedication to guiding clients through the mortgage process. This proactive approach not only keeps you top of mind but also builds trust and credibility, increasing the likelihood of conversion when potential clients are ready to move forward with their mortgage requirements.

Leveraging Analytics to Maximize Reach

Understanding your website’s performance is critical to your success as a mortgage professional. By utilizing analytics tools like Google Analytics, mortgage professionals can gain insights into their website’s traffic sources, monitor conversions, and track the effectiveness of their sales funnels. Mortgage professionals can use this data to make better decisions for their website. They can find areas to improve and create marketing strategies that attract more clients. Mortgage professionals can use analytics to measure their online success. They can also focus marketing efforts and increase reach in a competitive market.

Mortgage professionals must recognize the importance of having a website as a central hub for attracting and engaging potential clients. They can use email marketing and analytics to build relationships, track website performance, and improve sales. Mortgage professionals can become industry leaders and stay competitive by using effective strategies.

Create an Email Address Specifically for Your Mortgage Business

Creating an email address specifically for your mortgage business is crucial in establishing a professional and credible online presence. It not only adds legitimacy to your business but also helps you maintain a consistent brand image.

To create an email address for your mortgage business, follow these simple steps:

- Choose a domain name: Select a domain name that reflects your mortgage business, such as yourcompanyname.com or yourmortgagebusiness.com. This domain name will be used as part of your email address.

- Select an email provider: Look for a reputable email provider that offers reliable service and security features. Popular options include Google Workspace, Microsoft Office 365, and Zoho Mail.

- Set up the email account: Once you have chosen your email provider, sign up for an account using your chosen domain name. Follow the provider’s instructions to set up your account, including selecting a password and configuring email settings.

With a dedicated email address, you can communicate effectively with clients, prospects, and industry partners while ensuring that your mortgage business is easily identifiable and memorable.

Develop a Regular Communication Schedule with Potential Customers

Developing a regular communication schedule with potential customers is critical for mortgage professionals. Effective communication plays a vital role in establishing and maintaining relationships, nurturing leads, and staying top of mind with prospective clients.

Mortgage professionals can stay connected with potential customers by using a regular communication strategy. This helps keep customers informed and engaged during the mortgage process. Regular communication helps build trust and credibility, as it demonstrates a commitment to customer service and establishes the mortgage professional as a reliable resource.

To effectively communicate with potential customers, mortgage professionals can utilize various channels and methods. Email newsletters provide a convenient way to share updates, industry news, and valuable tips and insights. Social media platforms allow for real-time engagement and provide an opportunity to showcase expertise and build a following. Blog posts can serve as a platform to share in-depth information and address common questions and concerns.

Consistency is key in communication. By maintaining a regular schedule and delivering compelling content consistently, mortgage professionals can nurture leads and keep their services top of mind for potential customers. Regular communication helps build brand awareness and establishes a strong online presence, positioning mortgage professionals as trusted advisors in the industry.

Use Email Automation Tools to Streamline the Process

As a mortgage professional, having a website is crucial for establishing a strong online presence and connecting with potential clients. However, it’s equally important to have effective tools and strategies in place to streamline communication and stay in touch with clients. This is where email automation tools come in.

By leveraging email automation tools, mortgage professionals can streamline the process of staying in touch with clients, generating repeat and referral business. These tools allow you to automate sending personalized messages, such as notifying clients about potential refinancing options or sending birthday greetings.

One of the key benefits of using email marketing campaigns is the ability to nurture client relationships on autopilot. With automation, you can set up a series of well-crafted emails that are triggered by specific actions or at predetermined intervals. This helps to keep your mortgage services top of mind and ensures that your clients receive regular updates and valuable information.

In addition to saving time and effort, email automation tools also provide valuable insights through analytics. You can track open rates, click-through rates, and other important metrics to gauge the effectiveness of your campaigns and make data-driven decisions.

Investing in quality CRM software that allows for automated email marketing is essential for mortgage professionals. It provides features like contact management, segmentation, and personalization, enabling you to deliver targeted and relevant messages to your clients.

Analyze Data to Track Engagement and Improve Strategies

Data analytics plays a crucial role in understanding prospect behavior and optimizing mortgage professionals’ websites. By tracking metrics such as page views, time on site, bounce rates, and conversion rates through tools like Google Analytics, mortgage professionals can gain insights into how visitors are interacting with their website. This data can reveal which pages are performing well and which ones need improvement, helping them tailor their content and user experience to meet the needs of their target audience.

Additionally, data analytics can provide valuable information about the effectiveness of sales funnels and marketing tactics. By monitoring key conversion metrics, mortgage professionals can identify bottlenecks or areas of improvement in their sales processes. They can leverage this information to make data-driven decisions and adjust their marketing strategies accordingly.

Tracking data through CRM solutions also enables mortgage professionals to better understand their prospects and clients. By analyzing data such as lead sources, customer demographics, and engagement levels, they can personalize their communications and marketing efforts. This personalized approach can lead to higher engagement, conversions, and ultimately, more closed deals.

Add On Features That Make Your Site Stand Out from Competitors

Mortgage professionals need a website to seem trustworthy and get new clients. Through a well-designed and functional website, mortgage professionals can showcase their expertise and gain a competitive edge in the industry. There are additional features that allow you to stand out from the pack.

Incorporate a Mortgage Calculator Into Your Site

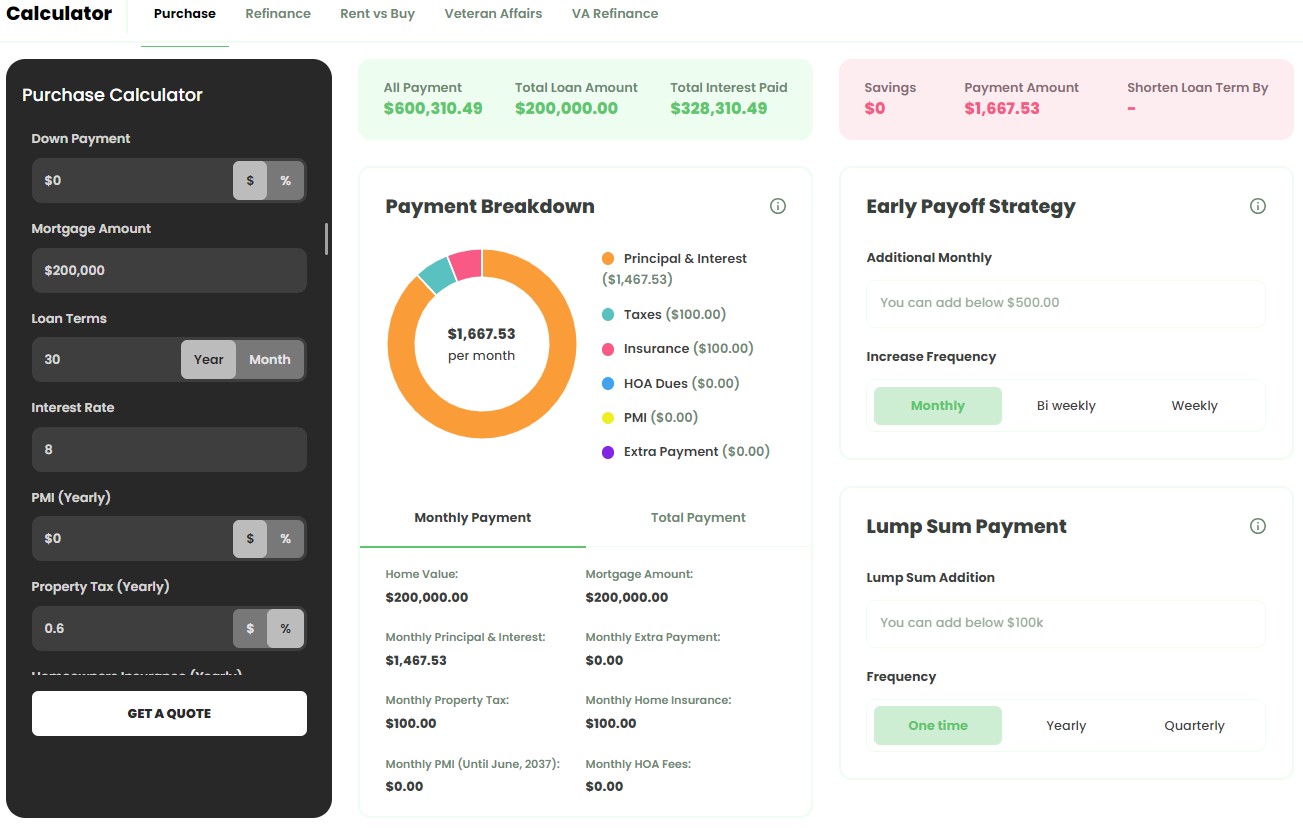

Adding a mortgage calculator to your website is crucial for mortgage experts. It offers a helpful tool for potential customers. A mortgage calculator allows individuals to estimate their monthly mortgage payment based on factors such as loan amount, interest rate, and payment term.

One of the key benefits of offering a mortgage calculator is that it empowers customers in their decision-making process. You can help people understand their mortgage payment and plan by giving them an easy way to estimate it. This can be especially useful for first-time homebuyers who may be unsure about the costs associated with homeownership.

Moreover, a mortgage calculator helps demystify the mortgage process. Customers can input different variables to see how adjusting the loan amount or interest rate impacts their monthly payment. This transparency can help potential customers feel more confident and informed throughout the mortgage application process.

When you add a mortgage calculator to your website, consider including different types of calculators for different customers. A mortgage calculator can estimate monthly payments. A loan comparison calculator helps customers compare loan options. Additionally, a refinance calculator can provide insights into potential savings for homeowners looking to refinance their current mortgage.

Adding a mortgage calculator to your website can attract customers and help them make good financial decisions. Additionally, showing transparency and satisfying customers helps foster strong and lasting client connections.

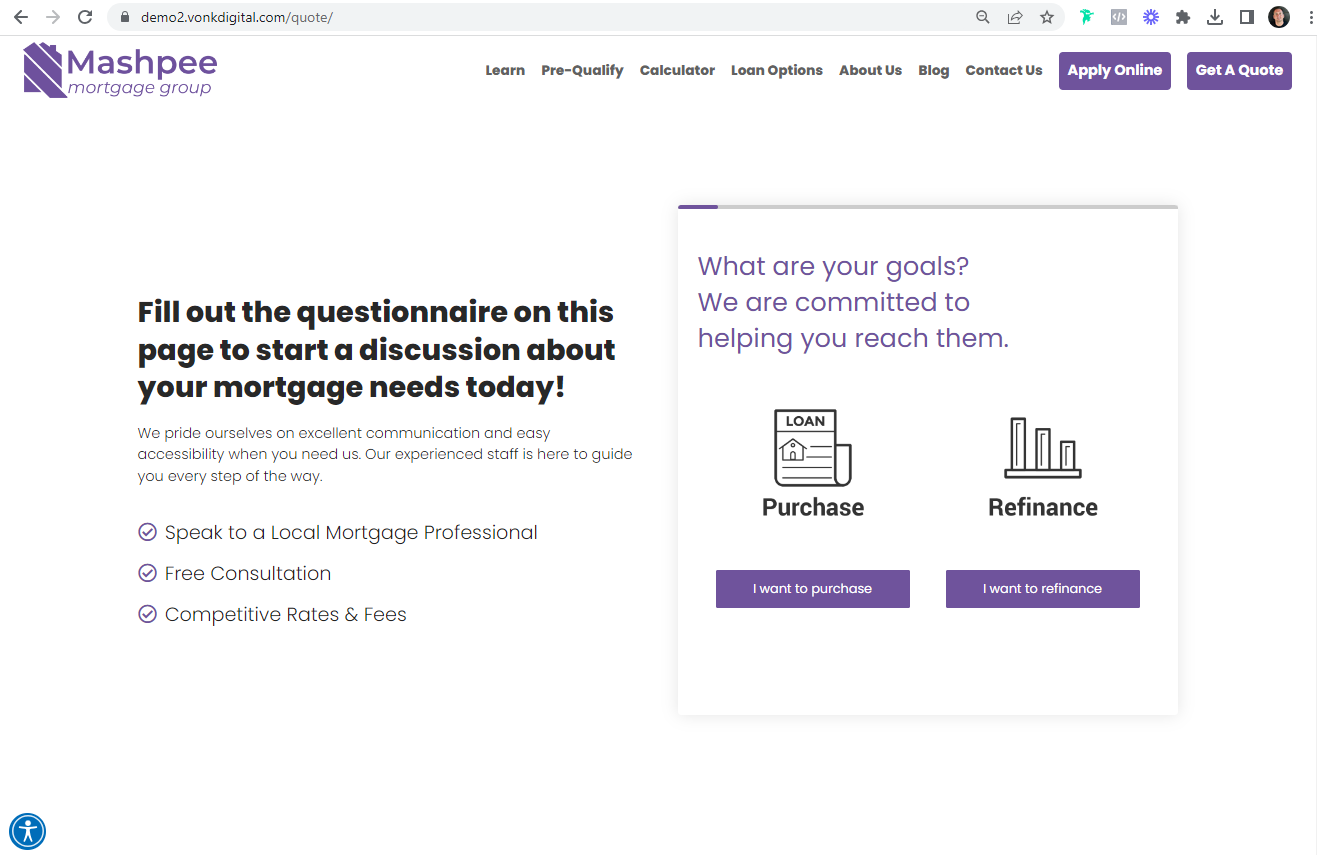

Include A Contact Form and Application Process on Your Website

To build relationships with clients and make mortgage inquiries easier, include a contact form and application process on your website.

A contact form allows visitors to easily reach out to you with any questions or inquiries they have regarding your services. By providing a convenient way for them to communicate, you can make it more likely that they will take the next step in their home-buying journey.

Additionally, including your contact information, such as your email address and phone number, adds credibility to your business. It reassures potential clients that you are a legitimate and trustworthy mortgage professional.

By including an application process on your website, you can streamline the mortgage application process for both you and your clients. This saves time and effort for all parties involved.

With these elements in place, your website provides immediate options for potential clients to get in touch with you, whether it be through a contact form or by directly calling or emailing. This increases the chances of capturing leads and converting them into clients.

To build credibility and connect with clients, include a contact form, the application process, and your contact information on your mortgage website. This will also help your business grow.

Frequently Asked Questions

Can a loan officer have their own website?

Yes, a loan officer can have their own website to showcase their services, share educational content, and provide contact information for potential clients. It’s a platform to build a professional online presence and generate leads.

How do I market myself as an MLO?

To market yourself as an MLO, establish a strong online presence through a professional website and social media profiles, network with real estate agents, and offer educational content on mortgage-related topics through blogs or workshops.

How do I know if my mortgage lender is reputable?

To determine the reputability of a mortgage lender, check for licensing through the Nationwide Mortgage Licensing System (NMLS), read online reviews, and seek referrals from satisfied customers or real estate professionals. Also, compare their loan rates and terms with other lenders.