People want to be able to do their own research on everything these days. The…

Establishing a strong brand identity is of key importance when building your mortgage website. A well-defined brand identity helps differentiate your mortgage business from competitors and creates a memorable impression on potential clients. It allows you to convey your unique value proposition, establish trust, and build long-term relationships with customers.

Understanding Brand Identity

Brand identity refers to the unique and distinct characteristics that set a business apart from its competitors in the eyes of its target audience. It encompasses the visual elements, messaging, values, and overall personality of a brand. Having a strong brand is important in mortgages to attract customers and build loyalty. With the increasing competitiveness in the market, businesses need to establish a distinct and memorable identity that resonates with their target market. Having a clear brand identity makes your image consistent on all platforms, like your website, social media, and marketing.

Businesses can build trust with potential clients by effectively explaining the benefits of their mortgage services. A strong brand identity helps position the business as a mortgage industry expert. This makes potential clients choose their services over competitors.

Key Benefits of Having a Strong Brand Identity

Mortgage websites need a strong brand identity. This attracts customers, sets them apart from competitors, builds credibility, and increases customer loyalty. In fact, a McKinsey & Company report stated that companies with solid brand identities outperform competitors by 20%.

A strong brand identity allows mortgage websites to effectively communicate their unique value proposition and connect with their target audience. A mortgage website can customize its messaging and design by understanding the target market and their needs. This will help it connect with potential clients.

Differentiating from competitors is another important benefit of a strong brand identity. In an industry as competitive as the mortgage business, it is essential to stand out and clearly articulate what sets your services apart. A well-crafted brand identity helps create a memorable and distinct impression in the minds of potential clients.

Establishing trust is important in the mortgage industry, and a strong brand identity helps build credibility. A mortgage website can build trust with potential clients by using professional branding elements. These include high-quality content, client reviews, and relevant certifications.

Furthermore, a strong brand identity fosters customer loyalty. Happy customers who have a good experience with a mortgage website are more likely to come back and tell others. A strong brand identity connects with customers, making them loyal and coming back for more.

Establishing Your Mortgage Website

Having a mortgage website is important. It helps establish your brand and connect with customers. Your website showcases your mortgage services and helps you stand out in the market. By incorporating branding and optimizing your online presence, you can communicate your value and build credibility. This leads to loyalty, repeat business, and referrals. In this article, we’ll explore the importance of a strong brand identity for your mortgage website and the benefits it brings. We’ll cover design, content, SEO, and user experience to establish an impactful online presence and drive traffic.

Target Market & Relevant Keywords

To attract customers and stand out, mortgage businesses need a strong brand identity. One key element of establishing a strong brand identity is identifying and understanding your target market.

To understand your target market, you need to know who your potential clients are. This includes their demographics, preferences, and needs. By conducting market research, you can gain valuable insights into your target market and tailor your website and mortgage services to meet their specific requirements.

In the mortgage industry, knowing your target market is essential for several reasons. Firstly, it helps you develop a marketing strategy that effectively reaches your desired audience. By understanding their preferences and needs, you can create compelling brand messaging that resonates with potential clients.

Knowing your target audience helps you make your website user-friendly and smooth. By analyzing customer demographics and preferences, you can optimize your website’s design and functionality to meet their expectations.

Lastly, knowing your target market can drive customer loyalty and satisfaction. By understanding their needs, you can provide personalized mortgage products and services that cater to their specific requirements.

Visual Elements & Branding Elements

For mortgage businesses, having a strong brand identity is important. It helps build customer loyalty and credibility, and it also helps them stand out from competitors. Your mortgage website plays a vital role in shaping your brand’s online identity and attracting potential customers.

Visual elements and branding elements play a significant role in creating a strong brand identity. The logo, for instance, represents your business visually and should be distinct, memorable, and easily recognizable. A good logo can help people recognize and remember your brand, making a strong impression.

The color scheme used throughout your website should be consistent with your brand’s personality and values. Colors evoke emotions and can influence how visitors perceive your brand. Choose colors that align with your brand’s message and appeal to your target market to create a cohesive and visually pleasing experience.

Typography, another key element, helps convey the tone and personality of your brand. Select fonts that are legible, visually appealing, and consistent with your brand’s image. A thoughtful choice of typography can enhance the overall user experience and reinforce your brand’s identity.

Incorporating high-quality imagery that resonates with your target audience is crucial. Consistent use of visually appealing images related to the mortgage industry can create a positive and professional impression.

If you consistently use these visual and branding elements on your mortgage website, you can create a strong brand identity. This will make you stand out from competitors and attract potential customers.

Mortgage Application Process & Products

Potential customers may find the mortgage application process overwhelming. However, a well-designed mortgage website can make it easier by guiding them through the necessary steps.

First, it’s important to educate potential clients about the different mortgage products available. This can include fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans. By offering a variety of options, you can cater to the unique needs of your target market.

Once customers understand their options, they can move forward with the application process. This typically involves gathering documentation such as income statements, tax returns, and bank statements. As mortgage brokers or business owners, you can provide a checklist of required documents on your website to help streamline this process.

With their documents in hand, customers are ready to submit the application. Your website should provide a clear and intuitive interface for this step, allowing customers to easily enter their information and submit the necessary forms.

One way to make the application process even smoother is by offering pre-approval. This allows potential clients to get a head start on their mortgage journey by determining how much they can borrow before they start house hunting. Pre-approval can save time and provide peace of mind for customers.

Make your mortgage website user-friendly to help customers apply for mortgages easily and efficiently. By having a strong online presence, you can demonstrate your knowledge of mortgages and gain trust from potential clients. This will result in happier customers and business growth.

Mortgage Calculators & Journey Tools

Having a strong brand identity is essential for businesses in the mortgage industry. Establishing trust and credibility with potential customers increases the likelihood of them choosing your mortgage services over competitors. One effective way to create a strong brand identity is through your mortgage website.

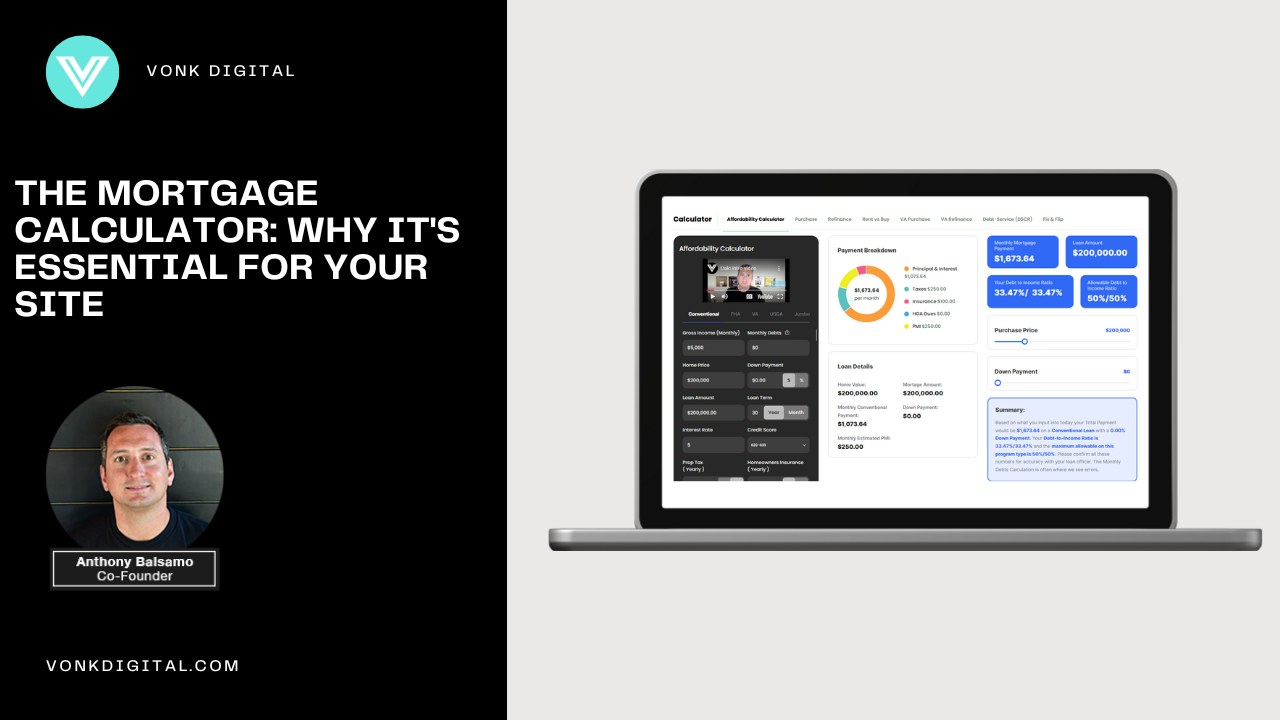

Offering tools like mortgage calculators and journey tools can greatly enhance the user experience. They provide information about services and the mortgage process. These tools help people with mortgages by letting them calculate payments, estimate affordability, and navigate the application process.

Mortgage calculators are helpful tools. They estimate monthly payments for potential clients. The calculations are based on loan amount, interest rate, and term. This helps them make informed decisions about their financial situation and ensures they can comfortably afford the mortgage.

Journey tools, on the other hand, guide potential borrowers through the application process. These tools provide step-by-step instructions, checklists, and resources to help streamline the process and make it more manageable.

When you include these tools on your mortgage website, you make it easier for users and show your commitment to helping clients with their mortgage journey. Having a strong brand identity helps attract and keep satisfied customers.

Optimizing Your Website for Search Engines

A strong brand is important in the mortgage industry. Your website is the foundation of your online presence and can help establish your brand. Optimize your website for search engines to attract your target market. Use keywords in your content, metadata, and headings to improve search rankings. Create high-quality content and use SEO strategies to drive traffic and capture clients’ attention. A strong online identity builds loyalty and credibility and grows your client base.

SEO Strategies to Maximize Visibility

Having a strong brand is important in the mortgage industry to attract customers and stand out. One of the most effective ways to establish a strong brand identity is through your mortgage website. To improve your website’s visibility and online presence, use strategic SEO strategies.

To make your website better for search engines, use important keywords in your content, metadata, and URLs. Find popular mortgage-related search terms and use them strategically in your website’s content. Additionally, building high-quality backlinks from reputable sources will signal to search engines that your website is trustworthy and authoritative.

Creating high-quality content is another key element in maximizing visibility. Publish blog posts, articles, and helpful content to meet your target market’s needs and concerns. This will not only attract potential clients through search engines but also position you as an industry expert and build customer loyalty.

Optimizing your website’s page speed is also crucial to improving its organic traffic. If your website loads slowly, potential clients may not explore it further. Users want a smooth experience. By optimizing your website’s load speed, you can increase customer satisfaction and lower bounce rates.

It is essential to use analytics tools to track your website’s performance and make informed decisions. Analyze user behavior, monitor traffic sources, and gain insights into how potential clients interact with your website. This data will help you refine your digital marketing strategy and optimize your website to attract and engage potential clients.

Blog Posts and Content Creation

Having a strong brand is crucial in the mortgage industry to attract customers and stand out. One effective way to establish this identity is through blog posts and content creation on your mortgage website.

Updating your blog often with great content makes you an industry expert and boosts your search rankings. By providing valuable information and addressing the needs and concerns of your target market, you can attract potential customers and keep them engaged.

By incorporating relevant keywords in your blog posts, you can optimize your website for search engines and improve its visibility to potential customers. This not only increases organic traffic to your website but also enhances your brand’s online presence.

Consistently publishing informative and relevant content also helps build customer loyalty and trust. It shows potential customers that you understand their challenges and can provide solutions, making them more likely to choose your mortgage services.

In conclusion, blog posts and content creation play a key role in establishing a strong brand identity for your mortgage website. By regularly updating your blog with high-quality content, you can attract potential customers, improve your search engine rankings, and build trust and loyalty with your audience.

Enhancing Your Online Presence

Enhancing Your Online Presence

Your mortgage business needs a strong online presence, and your website is key. To stand out from competitors and gain trust, create a unique brand identity on your website. This will establish you as an industry leader.

Social Media Platforms & Presence Strategies

In order to establish a strong online presence for your mortgage company, it is important to utilize various social media platforms effectively. These platforms not only provide a way to connect with potential customers but also enable you to showcase your brand identity and establish credibility in the mortgage industry.

One of the first steps to consider is identifying the social media platforms that are most relevant to your target audience. Facebook, Twitter, and LinkedIn are popular platforms that can help you reach a wide range of potential clients. Each platform has its own unique features and advantages, so it is important to tailor your presence strategies accordingly.

Creating valuable content is essential to engaging with your audience and building trust. By sharing relevant information and insights about the mortgage industry, you can position yourself as a trusted authority. Consider creating blog posts or videos that address common concerns or questions your target audience may have about the mortgage process.

Engaging with your audience is also key. Responding to comments, messages, and reviews promptly and professionally shows that you care about your potential clients’ experiences. Encourage your audience to ask questions and provide feedback, and be sure to follow up with personalized responses.

Promoting your services on social media is another effective strategy. Highlight the unique aspects of your mortgage services and explain how they can benefit potential clients. Utilize eye-catching graphics and compelling brand messages to capture the attention of your audience.

Finally, use social media ads to reach more people and target specific groups. Facebook and LinkedIn ads, for example, allow you to target users based on their location, age, interests, and more. This can help you reach potential clients who are most likely to be interested in your mortgage services.

To create a strong brand, connect with your target audience, and become a trusted authority, use these social media strategies.

Email Signatures and Business Cards

Your email signature and business card help establish a strong brand identity for your mortgage company. These materials provide contact information and help market your online presence effectively.

When it comes to email signatures, it is crucial to include key contact information such as your name, title, phone number, and email address. Making it easy for potential clients to reach you also shows professionalism and credibility. Including your company logo and website link in your email signature also reinforces your brand identity and directs recipients to your online presence.

Similarly, business cards are a tangible representation of your brand. Make sure to include essential elements such as your logo, company name, website URL, and social media handles. These visual elements help create consistency across your marketing materials and allow potential clients to easily find and engage with your online platforms.

It is important to have a strong brand identity. This can be done through email signatures and business cards. This will help promote your mortgage services. It ensures that prospects and clients have the necessary contact information to reach out to you while reinforcing your brand image. By incorporating these elements into your promotional materials, you can effectively showcase your professionalism and stand out in the competitive mortgage industry.

Online Ads and Promotions

In today’s digital age, establishing a strong online brand identity is essential for mortgage companies looking to thrive in the competitive market. One powerful strategy to increase brand visibility and generate leads is through online ads and promotions.

Platforms like Facebook offer targeted advertising options that allow mortgage companies to effectively reach their desired audience. Businesses can ensure that potential customers who are more likely to be interested in their mortgage services see their ads by carefully selecting relevant demographics, interests, and behaviors. This targeted approach not only increases the chances of conversion but also maximizes the return on investment.

To enhance brand visibility and establish credibility in the mortgage industry, you can use different posting options on Facebook. These options include creating engaging graphics, sharing informative blog posts, and showcasing client reviews. These posts can be strategically planned using a content calendar to ensure a consistent brand identity and keep the audience informed and engaged.

Social media marketing goes beyond just advertising. It allows mortgage companies to connect with their audience on a personal level, share valuable content, and foster a sense of community. By regularly posting educational and informative content related to the mortgage industry, companies can position themselves as experts and build trust with their target customers. This, in turn, leads to increased customer loyalty and a higher likelihood of repeat business.

By using online ads and promotions, as well as a solid social media marketing plan, a mortgage company can greatly increase its brand visibility. This can lead to more leads and business growth. Embrace these digital marketing techniques to showcase your mortgage services and position your brand as a trusted industry leader.

Frequent Questions Answered

How do you build a strong brand identity?

Building a strong brand identity involves a clear understanding of your business goals, target audience, and value proposition. It requires consistency in messaging and visual elements across all platforms, and creating a memorable and distinct brand image that resonates with your audience.

How do you create a brand identity?

Creating a brand identity starts with researching and understanding your market and audience. Develop a clear brand strategy, create a memorable logo, choose a consistent color palette and typography, and ensure that all marketing materials reflect your brand values and message.

What makes a brand identity unique?

A unique brand identity stems from a distinctive brand story, a clear value proposition, and a consistent yet distinct visual and verbal communication style that sets you apart from competitors. It’s how your brand expresses itself consistently across all platforms while resonating with your target audience’s values and expectations.

Conclusion

Brand identity and website design are important for mortgage companies to establish credibility and gain a competitive edge in a crowded market.

A strong brand identity helps customers remember and refer to your mortgage company.

A good website is important for marketing. It shows your mortgage services, educates your target market, and provides a smooth user experience. Increase visibility and drive traffic with content creation and a social media presence. Create great content and use social media to reach more people, connect with potential clients, and establish yourself as an industry expert.

In the modern digital age, it’s crucial to have a strong brand and online presence to attract clients and stand out. By investing in your mortgage website, you can build a strong brand identity. This will lead to increased customer loyalty and a competitive edge in the mortgage industry.