People want to be able to do their own research on everything these days. The…

Starting out in the mortgage business with a strong website is like putting your best foot forward in a crowded field. A well-designed website not only shows off the potential of your business, but it also gives potential borrowers a safe place to go, which is essential for a successful lending venture.

What is a Professional Mortgage Website?

A mortgage website can help mortgage professionals build their online presence and reputation. In the modern world, it’s important to have a good website to attract borrowers, display loan options, and gain trust in the mortgage industry. A mortgage website is a central hub where visitors can learn about mortgages, use calculators, and find brokers and lenders. In addition, it serves as a marketing tool for mortgage professionals. They can use it to promote their services and connect with potential borrowers through email campaigns and contact forms. It also allows them to share valuable content like blog posts and informative resources. With a professional mortgage website, mortgage professionals can stand out from competitors, nurture leads, and ultimately grow their lending business.

Benefits of Creating Professional Mortgage Website

Mortgage professionals can benefit from having a professional mortgage website. It helps them establish an online presence and attract potential borrowers. Today, many homebuyers use the internet to find mortgage services, so it’s important to have a well-designed website.

Mortgage professionals can show off their skills and loan choices on a mortgage website. Lenders can teach potential borrowers about the mortgage process, loan application process, and different mortgage products by giving them detailed information about all of these things. They can also show that they know a lot about the mortgage business. The website is better when it has tools like mortgage calculators and credit score information. It also helps to have descriptions of real estate services.

One of the key advantages of a professional mortgage website is the ability to build trust. By including borrower reviews and testimonials, lenders can showcase their track record of successfully helping homebuyers navigate the mortgage process. Furthermore, including a contact form on the website makes it easy for potential borrowers to reach out. This also helps build trust and boosts the chance of conversion.

Having a professional mortgage website is important in today’s digital age for marketing. It enables lenders to reach a wider audience, effectively communicate their services, and attract potential borrowers. Lenders can create a website that is easy to use and interesting. This helps them show their knowledge, share helpful information, and gain people’s trust.

Design Considerations for A Professional Mortgage Website

A good mortgage website must look nice, be easy to use, and work well with search engines. Clean and modern design and layout should show that the mortgage company is professional and knows what they’re doing. It’s important to think about who you’re trying to reach and make sure the website is easy to use, with clear calls to action that lead people to the right parts of the site.

In today’s digital era, many people use smartphones and tablets to access the internet. Therefore, mobile responsiveness is crucial. Users should be able to enjoy the website on all devices because it should be easy for it to adjust to different screen sizes.

Adding strong and relevant visuals, like high-quality photos and videos, can make the website even more appealing. This can involve displaying beautiful homes, professional photos of the team, and helpful videos explaining the mortgage process. You can add a blog section. The blog will post information about mortgages and answer questions.

For a professional mortgage website to do well in search engine results, it needs to use good SEO techniques. To optimize a website for search engines, use relevant keywords in content and metadata. Ensure quick loading times and easy crawling for search bots. Using email campaigns, social media marketing, and other digital marketing can strengthen online presence. This can attract people to the website and build a strong online brand for the mortgage company.

To create an effective mortgage website, follow these design tips. This will help showcase the company’s expertise and loan options, build trust with potential borrowers, and make it a valuable tool for homebuyers during the mortgage process.

User-Friendly Interface

A user-friendly interface is of utmost importance for a professional mortgage website. It plays a vital role in creating a positive user experience and greatly contributes to attracting and retaining potential borrowers.

A user-friendly website is easy to navigate and find information, so people don’t get lost or frustrated. The smooth experience makes things easier for users and helps people trust the mortgage company.

The design should make it easy for users to navigate between website pages and sections. A clear and organized layout helps users quickly locate important information and understand the offerings of the mortgage company.

In addition, the company provides simple forms for mortgage inquiries and applications. This makes it easier for potential borrowers to contact the company. Fast-loading pages ensure that users do not have to wait for an extended period, providing a smooth and efficient experience.

A mortgage website can attract borrowers by being easy to use. This can lead to more engagement and conversions. In today’s digital age, a seamless user experience is crucial for a mortgage company’s online success.

Responsive Design

Responsive design is crucial for creating a professional mortgage website that caters to the needs of modern users. As more people use mobile devices, responsive design helps your website work well on any screen.

Mobile traffic is essential for online success in today’s digital landscape. More and more people are using their smartphones and tablets to search for mortgage brokers and explore loan options. A mobile-friendly design allows you to capture this potential borrower base by offering an optimized browsing experience on mobile devices.

Responsive design has key features such as mobile-focused templates that prioritize mobile browsing. To design effectively for mobile, think about the small screen and touch-friendly features. Easy navigation is also crucial, with clear menus and clickable buttons that make it effortless for users to move between different sections of the website.

Compatibility with various mobile devices is another important consideration. Your responsive design should work seamlessly across different platforms, whether it’s an iPhone, Android phone, or tablet. This ensures that all potential borrowers have access to your website, regardless of the devices they use.

In short, your mortgage website needs a responsive design to attract mobile users and be user-friendly. By prioritizing mobile-centric templates, easy navigation, and compatibility with different devices, you can enhance your online presence and attract potential borrowers.

Security Features

In today’s digital age, security is critical for any professional mortgage website. Borrowers trust mortgage brokers with personal information, like Social Security numbers and finances. Implementing robust security features not only protects your borrowers but also helps to build trust and credibility in your online presence.

One essential security feature for a mortgage website is an SSL certificate. This security protocol makes sure that data between the website and borrower’s browser is safe. SSL certificates create a secure connection, indicated by the padlock icon in the browser’s address bar, giving borrowers peace of mind knowing that their information is protected.

Another security measure is a firewall, which acts as a barrier between your website and potential threats. Firewalls monitor and control incoming and outgoing network traffic, preventing unauthorized access and protecting against malicious attacks.

In addition to SSL certificates and firewalls, implementing strong password protocols is crucial. Encourage borrowers to pick strong passwords with letters, numbers, and special characters. Regularly remind them to update their passwords and avoid using the same passwords across multiple platforms.

When handling borrower information, it is essential to maintain the highest level of security. Ensure that borrower data is encrypted and stored securely. Limit access to sensitive information only to authorized personnel and regularly audit your security measures to identify any vulnerabilities.

To make your mortgage website secure and trustworthy, use security features and follow best practices. This will protect borrower information and gain borrowers’ trust.

Note: While integrating keywords is important for SEO, it’s equally important to create content that flows naturally and provides value to the reader.

Integrating Technologies

Integrating various technologies with your professional mortgage website can greatly enhance workflow efficiency and improve the overall user experience. You can make the loan application process easier by connecting different web services. These services include CRM systems, Google Analytics, email marketing, and live chat widgets. Connecting them allows for real-time communication with potential borrowers.

Integrating a CRM system helps you keep all borrower information in one place. It also helps you track interactions and manage leads efficiently. It enables you to nurture leads, automate follow-ups, and personalize communications based on borrower preferences.

Also, by using Google Analytics, you can learn about website traffic, conversions, and user behavior. This data helps you measure the effectiveness of your marketing efforts and make informed decisions about optimizing your website.

You can connect with potential borrowers easily by integrating email marketing. Use personalized email campaigns. You can automate email workflows, send newsletters, and share relevant content to keep borrowers engaged throughout the mortgage process.

Lastly, live chat widgets allow for real-time communication, enabling quick response to borrower inquiries. This fosters trust and improves customer satisfaction by providing immediate assistance and support.

The benefits of integrating these technologies are numerous. It streamlines the loan application process, making it easier and more convenient for borrowers. It also enables efficient lead management and personalized communication, enhancing customer experience. Ultimately, integrating these technologies with your professional mortgage website positions you as a modern and tech-savvy mortgage professional, helping you attract and retain borrowers in an increasingly digital world.

Content for A Professional Mortgage Website

If mortgage professionals want to build and grow their online profile, they need to make a professional mortgage website. A well-designed website can be a great way to sell your business by bringing in potential borrowers and showing off your knowledge of the mortgage industry. To make your website unique, consider adding a customer relationship management system. This will help you manage leads and send personalized messages to borrowers.

You can use Google Analytics to learn about website traffic and user behavior. This information can help you improve your marketing strategy. With email marketing integration, you can send personalized ads to potential borrowers. Live chat widgets allow you to talk to borrowers immediately, making them happier. By adding these features to your mortgage website, you can give users a great experience and show that you are a trustworthy mortgage professional.

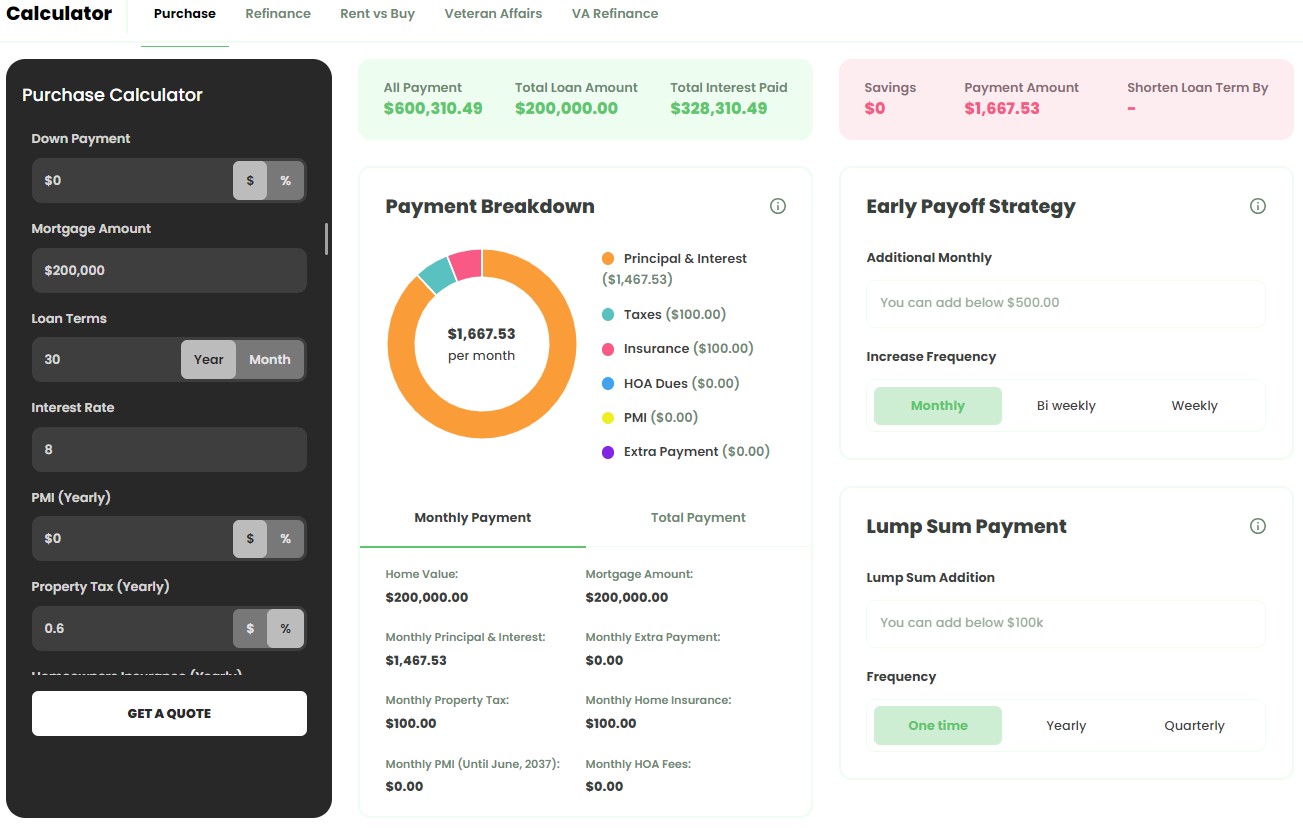

Online Mortgage Calculators

Online mortgage calculators are an essential component of any professional mortgage website. These powerful tools serve as qualifying tools and provide potential borrowers with valuable information about their credit score and loan options.

By adding online mortgage calculators to a website, you can pre-qualify potential borrowers. Users can enter their financial information into the calculator to find their credit score and see available loan options. This not only saves time for both the mortgage professional and the potential borrower but also ensures that the leads generated are more qualified.

An effective mortgage calculator should have several features and functionalities. Firstly, it should be able to automatically determine whether an applicant is eligible for a home loan or not. This saves both the mortgage professional and the potential borrower time and effort by eliminating manual screening processes.

A good mortgage calculator can also collect prospect information to get more potential borrowers. This includes features such as capturing contact information and storing it for further follow-up. By capturing prospect data, mortgage professionals can nurture these leads and potentially convert them into borrowers.

In summary, online mortgage calculators are important on professional mortgage websites. By incorporating these tools, mortgage professionals can provide valuable information to potential borrowers, qualify leads, and generate new business opportunities. Mortgage professionals should invest in a good mortgage calculator. The calculator should meet their target audience’s needs and help with lead generation.

Testimonials from Previous Borrowers

Testimonials from past borrowers build trust and credibility for the mortgage website. These testimonials can provide real-life examples of how the website’s services have helped borrowers successfully navigate the mortgage process and achieve their homeownership goals.

Contact Form to Connect with Potential borrowers

Having a professional mortgage website is essential for mortgage professionals in today’s digital age. It helps them grow their businesses. One key element that should not be overlooked is the inclusion of a contact form.

The contact form is a way for people to ask questions or make appointments. By providing a convenient way for visitors to get in touch, you create opportunities to convert them into actual borrowers.

When creating your contact form, make sure to include fields for important contact details like name and email. These details allow you to follow up with potential borrowers and nurture the relationship further. Additionally, by obtaining their contact information, you can build your database and stay connected with individuals who have expressed interest in your services.

By incorporating a well-designed contact form on your professional mortgage website, you establish a direct line of communication with potential borrowers. It not only adds a layer of professionalism to your website but also provides a valuable platform for capturing relevant contact details. Don’t miss out on the opportunity to connect with potential borrowers and grow your mortgage business online.

Strategies to Promote Professional Mortgage Websites

The first step to establishing an online presence for your mortgage business is creating a professional website. To truly make an impact and attract potential borrowers, you need to implement effective strategies to promote your website.

One crucial aspect of promoting your website is search engine optimization (SEO). By optimizing your website for relevant keywords such as “mortgage brokers” or “mortgage industry,” you can improve your search rankings and increase your online visibility. This will help potential borrowers find your website when they search for mortgage-related information or services.

In addition to SEO, leveraging social media marketing can greatly enhance your online presence. By sharing valuable content and engaging with your target audience on platforms like Facebook, Twitter, and LinkedIn, you can further establish yourself as a knowledgeable mortgage professional and drive traffic to your website.

Another effective strategy is email marketing. You can build a database of potential borrowers by using your website’s contact form. Then, you can nurture these relationships with email campaigns. Sending informative newsletters, updates on loan options, and personalized messages can keep your business top of mind and encourage potential borrowers to take the next step.

Also, think about adding blog posts to your website that answer common mortgage questions. This not only demonstrates your expertise but also improves your website’s search engine rankings. By providing valuable and relevant content, you can attract organic traffic and establish your website as a go-to resource for mortgage information.

To promote your mortgage website, use SEO, social media, email campaigns, and valuable content. You can use these strategies to bring more people to your website and grow your mortgage business.

SEO Optimization

To have a successful mortgage website, it’s important to optimize it for SEO. This helps people find it online. By strategically incorporating relevant keywords like “mortgage brokers,” “mortgage industry,” “online presence,” “search engine optimization,” and “mortgage business,” you can improve your website’s rankings on search engine results pages (SERPs). When you have higher rankings, you get more people visiting your website without advertising. This can bring in more potential borrowers and more chances for business.

When someone looks for mortgage info or services, Google analyzes websites to give the best results. Optimizing your mortgage website with targeted keywords helps search engines understand the content and purpose of your website, improving its chances of being displayed at the top of SERPs. This exposure increases visibility, credibility, and trustworthiness in the eyes of potential borrowers.

Additionally, SEO optimization improves the user experience. It makes your website more accessible, faster, and easier to navigate. This positive user experience encourages visitors to spend more time on your website, increasing the likelihood of them converting into leads or borrowers.

Ad Campaigns

Ad campaigns are a crucial component of promoting a professional mortgage website and driving traffic to your online platform. Here are some types of ad campaigns you can use:

- Pay-per-click (PPC) Campaigns: With PPC campaigns, you pay for each click on your ad. These ads appear at the top or side of search engine results pages, allowing you to target specific keywords related to the mortgage industry. Benefits include increased visibility, control over ad spend, and the ability to track conversions.

- Display Advertising Campaigns: Display ads are banners or images that appear on websites within the Google Display Network or other advertising networks. These visually appealing ads can attract potential borrowers and offer brand exposure on relevant websites.

- Social Media Advertising Campaigns: Utilizing platforms like Facebook, Instagram, or LinkedIn can help you reach a wider audience and engage potential borrowers. These campaigns can target specific demographics, interests, or behaviors. Social media ads also provide shareability, increased engagement, and the ability to track performance.

Competitors in the mortgage industry use successful ad campaigns. They target PPC campaigns with keywords like “professional mortgage website design”. They also run display advertising campaigns on real estate websites. These campaigns increase website traffic, generate leads, and establish brand recognition among the target audience.

Overall, ad campaigns are an effective way to promote a professional mortgage website and attract potential borrowers in the mortgage industry.

Frequently Asked Questions

What are the qualities of a professional website?

A professional website should exhibit a clean and intuitive design, fast loading times, mobile responsiveness, and clear calls to action. It should also have high-quality, relevant content, easy navigation, and contact information readily available.

How do I market my mortgage broker?

Marketing a mortgage broker could entail leveraging online platforms, local networking, and borrower referrals. Utilizing social media, SEO, and paid advertising can help increase online visibility, while joining local business groups and encouraging satisfied borrowers to refer others can also be effective.

What is the conversion rate for the mortgage industry?

The specific conversion rate for the mortgage industry can vary. However, in the context of mortgage lending, a conversion could be considered as a lead turning into a loan application. The conversion rates might be influenced by various factors such as market conditions and the effectiveness of the marketing strategies employed.

How do I get more borrowers for my mortgage?

Getting more borrowers for your mortgage business can be achieved through effective marketing strategies like online advertising, social media marketing, and local networking. Offering exceptional service to current borrowers can also lead to referrals, and partnering with real estate agents or other local businesses can also prove beneficial.

Conclusion

Mortgage websites help brokers, lenders, and professionals expand their online presence and revenue. Elegant websites, smart content, and successful digital marketing strategies like PPC and social media advertising can boost visibility and lead creation. This important step boosts the credibility of mortgage experts and helps them succeed in the industry.