People want to be able to do their own research on everything these days. The…

Mortgage Experts must create a distinctive online presence for their mortgage website to stand out. Having a well-organized website is important to show your expertise, values, and unique solutions to potential borrowers. It provides a strong foundation.

The most critical point for your prospects to be able to get information about you is no longer at the Point-of-Sale in the real world; it’s at the “Point-of-Research”

Your website is the “Point-of-Research” for your prospects. It’s the one location you can leverage to build trust and showcase your experience, your happy clients, and your knowledge. Your website is your digital resume.

People now value information they find on their own more than information told to them.

What is a Mortgage Website?

Mortgage brokers, loan officers, and mortgage companies need a website to compete in the industry. It serves as a platform to showcase mortgage programs, provide information about the mortgage lending process, and engage with potential borrowers.

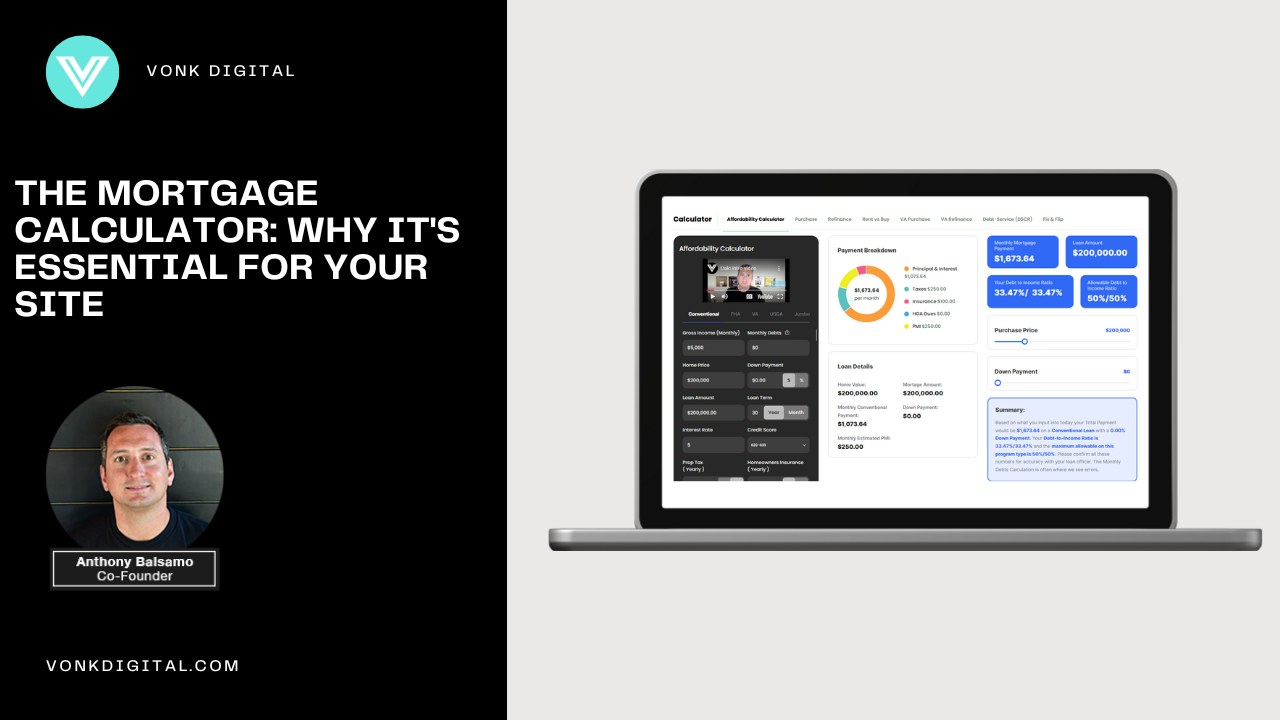

A good mortgage website should be easy to use, have interesting information, and let you manage your contacts. It should also incorporate key elements such as mortgage calculators, contact details, and borrower testimonials to build credibility and social proof. A mortgage website can attract borrowers by using technology and optimizing for search engines. It can generate leads and turn them into satisfied borrowers. A mortgage website is a valuable tool for mortgage professionals. It has great content, communication tools, and extra features. It improves customer satisfaction and helps businesses grow in the digital world.

Benefits of Having a Mortgage Website

Mortgage professionals need a website to grow their business and establish an online presence. Having a mortgage website offers numerous benefits for lead generation, brand building, and customer relationship management.

Firstly, a mortgage website serves as a powerful lead generation tool. It enables potential borrowers to easily find and reach out to mortgage brokers, increasing the chances of converting them into borrowers. By incorporating contact forms and compelling content, mortgage professionals can capture valuable leads and nurture them through the sales process.

Secondly, a mortgage website plays a crucial role in brand building. It allows mortgage brokers to showcase their expertise, experience, and unique selling propositions. By providing valuable content related to mortgage terms, loan programs, and industry trends, brokers can establish themselves as trusted authorities in the mortgage industry. This helps in gaining credibility and trust among potential borrowers.

Thirdly, a mortgage website helps with customer relationship management. Mortgage professionals can use their websites to communicate with prospective borrowers. Through contact management tools, email marketing, and communication tools, brokers can efficiently interact with borrowers, providing personalized support and addressing their specific needs.

Additionally, a mortgage website offers advantages in terms of user-friendliness for visitors. A well-designed and easy-to-navigate website enhances the customer experience, making it convenient for potential borrowers to find the information they need and contact the mortgage broker.

Furthermore, by optimizing their websites for search engines, mortgage professionals can increase their online visibility and attract organic traffic. This helps them reach a wider audience and expand their reach.

A mortgage website is, in summary, a vital resource for mortgage professionals. It improves customer relationship management, creates leads, and increases brand value. A mortgage website’s user-friendliness and search engine optimization capabilities enable mortgage brokers to expand their companies and offer their borrowers exceptional service.

Design Considerations

When it comes to building a mortgage website, there are several important design considerations to keep in mind. Firstly, the website should be visually appealing and professional, reflecting the credibility and expertise of the mortgage professional. Engaging potential borrowers and giving them information requires clear, concise, and easy-to-read content. The website should also work well on mobile devices, so users have a smooth experience. Intuitive navigation and well-organized sections make it easy for visitors to find what they are looking for, such as mortgage programs, calculators, and contact information.

Incorporating visual elements like infographics and videos can also enhance the website’s appeal and convey complex information in an engaging manner. Lastly, you can use social proof to build trust and credibility. Show borrower testimonials and success stories to reassure potential borrowers. This will help them feel confident in choosing the mortgage professional. By considering these design elements, mortgage professionals can create a website that effectively showcases their expertise, engages potential borrowers, and ultimately drives business growth in the competitive mortgage industry.

User-Friendly Interface

A user-friendly interface is crucial for a mortgage website to provide a positive user experience and drive potential borrowers towards conversion. Here are some essential tips to achieve a user-friendly interface:

- Simplify navigation: Ensure that the website’s menu is intuitive and easy to navigate. Organize the content into logical categories, making it effortless for users to find the information they need.

- Streamline the design: adopt a clean and minimalist design approach. Avoid cluttering the pages with excessive text or images. Use white space effectively to create breathing room and highlight essential elements.

- Optimize for mobile: In today’s mobile-first world, it is essential to have a responsive design that adapts seamlessly to different screen sizes. This allows users to access the website on their mobile devices without sacrificing functionality.

- Prioritize readability: Use legible fonts, appropriate font sizes, and clear color contrasts to enhance readability. Break up large chunks of text with headings, bullet points, and paragraphs to make it easier for users to scan and digest the content.

- Provide intuitive forms: If your website offers online applications or contact forms, keep them simple and easy to fill out. Use clear instructions and logical input fields, and minimize the number of required fields to maximize convenience for users.

Mortgage professionals can make online experience better by using user-friendly interfaces. This can help drive conversions and grow their business.

Responsive Design

Responsive design is a crucial aspect of a successful mortgage website. In today’s mobile-driven world, it is essential to provide a seamless user experience across all devices. A responsive design ensures that your website adapts effortlessly to different screen sizes, making it accessible and user-friendly on desktops, tablets, and smartphones.

By implementing a responsive design, you enhance the user experience in a multitude of ways. Firstly, it allows for easy use on any device, resulting in a faster and more transparent browsing experience. Your potential borrowers can access your website from anywhere, at any time, without sacrificing functionality or visual appeal.

A responsive design makes your website work well on different browsers, giving all users a consistent experience. Additionally, with mobile responsiveness, your website automatically adjusts its layout and content to fit smaller screens. This ensures that your message and important information are easily readable and accessible to potential borrowers, no matter which device they are using.

In addition, a responsive design is easy to customize, so you can make updates easily and efficiently. Your website can stay current, making you more competitive in the mortgage industry.

Customizable Content: Enhancing the Mortgage Website Experience

A successful mortgage website needs customizable content that meets borrowers ‘ specific needs. You can interact with your target market and position yourself as an informed authority in the mortgage industry by providing useful content that is suited to particular audiences.

The incorporation of mortgage calculators is an essential component of content that can be customized. With these tools, visitors can quickly and accurately calculate their monthly payments. This helps them make informed financial decisions. Furthermore, educational articles that answer frequently asked questions and concerns offer insightful analysis and demonstrate your expertise.

To make the user experience more personal, offer downloadable materials such as checklists, e-books, and guides. These resources can help you effectively nurture leads by collecting contact information from potential borrowers and offering extra value.

Remember, to create effective content, know your audience and adjust your message for them. You can increase your chances of converting leads into borrowers by offering potential borrowers a personalized and engaging experience through the use of tools such as mortgage calculators, educational articles, and downloadable resources.

Professional Look and Feel

It is very important to make your mortgage website look professional and trustworthy to attract borrowers . A clean and modern design not only enhances the visual appeal but also reflects your commitment to professionalism in the mortgage industry.

When visitors land on your website, they should feel assured that they are dealing with a reputable mortgage company. A professional design instills confidence and trust, making potential borrowers more likely to engage with your website and explore the services you offer.

To achieve this, it is crucial to focus on professional branding. Consistent use of your company logo, fonts, and colors across your website helps create a cohesive and recognizable brand presence. This reinforces the perception of a trustworthy and established mortgage business.

In addition, using good pictures related to mortgages can make your website look better. They not only lend credibility but also capture the attention of potential borrowers , making them more likely to stay and explore your content.

Using a color scheme that matches your brand can make your website look professional and cohesive. A well-chosen color palette can evoke emotions and subtly influence the perception of your brand.

Basically, giving your mortgage website a professional look and feel can help potential borrowers trust and believe in your business. This will make them more likely to look into the mortgage options you offer.

Essential Features of a Mortgage Website

To grow their business in the digital age, mortgage professionals need a strong online presence. An attractive and user-friendly mortgage website is a vital tool that can help you draw in and interact with prospective borrowers, expedite the sales process, and ultimately increase your success in the mortgage market. To make a mortgage website effective and achieve good results, it should include key components. We will discuss these components in this article.

If your website has these features, it will stand out from the competition. These features include expert branding, pleasing design, interactive tools, and smooth communication. They will also provide a remarkable user experience. Whether you are a mortgage broker, loan officer, or owner of a mortgage company, incorporating these crucial features into your website’s optimization will help you connect meaningfully with your target audience, create credibility, and foster trust—all of which will ultimately propel growth and success in the mortgage sector.

Online Presence and Social Proof

To succeed in the mortgage industry, a mortgage website needs a strong online presence and social proof. In today’s digital age, potential borrowers turn to the internet to research and evaluate mortgage brokers and companies. Establishing a strong online presence allows mortgage professionals to connect with a wider audience, build trust, and showcase their expertise.

One effective way to build trust and credibility is through borrower testimonials and online reviews. Positive feedback from satisfied borrowers can significantly influence potential borrowers’ decision-making processes. By featuring testimonials and reviews on the website, mortgage professionals can provide social proof of their excellent service and customer satisfaction.

To collect borrower testimonials and reviews, mortgage professionals can leverage popular platforms like Facebook, Yelp, Zillow, and Google My Business. These platforms allow borrowers to share their experiences and rate the service they receive. Reviews from these platforms are shown on the website, giving potential borrowers real feedback.

Using plugins, mortgage professionals can easily display verified third-party reviews on their websites. These plugins streamline the process of integrating testimonials and reviews, ensuring that the displayed feedback is genuine and trustworthy. The inclusion of borrower testimonials and online reviews not only enhances the overall user experience but also reinforces the trustworthiness and credibility of the mortgage professional.

To attract and convert potential borrowers in the mortgage industry, it’s important to have a strong online presence and show social proof. Mortgage professionals can gain trust and a good online reputation by using borrower testimonials and online reviews. They can also use plugins.

Benefits of Having a Mortgage Website

Mortgage professionals need a good website to be credible, build trust, and offer help. It showcases the business, features borrower testimonials, and offers a mortgage calculator for easy payment estimates. The website also positions professionals as trusted advisors, attracting potential borrowers and promoting business growth. With the right technology and tools, a mortgage website can be a powerful asset for mortgage professionals.

Build Authority and credibility.

In the mortgage industry, it’s important for a website to gain trust and attract borrowers. This can be done by building authority and credibility. A reliable and modern website design plays a significant role in creating a positive first impression. A well-designed website with easy navigation, clear content, and a professional appearance instills confidence in visitors.

To further enhance credibility, incorporating social proof into the website is essential. borrower testimonials and reviews provide real-life examples of successful mortgage transactions, assuring potential borrowers of the company’s expertise and reliability. Teaming up with respected authors and websites in the mortgage industry can increase credibility. Collaborating with industry experts and featuring their content on the website demonstrates the company’s commitment to being a trusted source of information and expertise.

The website provides valuable content and assets to engage with borrowers and gain benefits. By providing informative articles, resources, and tools such as a mortgage calculator, the website becomes a go-to destination for potential borrowers seeking knowledge and solutions. This establishes the company as an industry leader and fosters trust among visitors. Additionally, effective communication tools like contact forms and email addresses enable seamless interaction, building relationships with borrowers and addressing their queries promptly.

Lead Generation Opportunities

Mortgage professionals can find many ways to generate leads on a mortgage website. They can use it to grow their online presence. With a well-designed website, these professionals can attract and capture leads in a way that is less intrusive and more effective.

One such approach is leveraging lead paths and lead magnets. Lead paths help potential borrowers by showing them useful and personalized content. This helps guide them through the sales process. By offering lead magnets, such as valuable resources or special offers, mortgage professionals can entice visitors to provide their contact information in exchange.

To optimize mortgage lead generation, it is crucial to focus on designing an appealing website. A user-friendly interface, clear call-to-actions, and compelling content all contribute to maximizing conversions. Embedding progressive forms on the website’s landing pages allows for capturing leads at various stages of the customer journey, gradually obtaining more information as trust is built.

A well-executed content marketing strategy is also essential. By consistently producing valuable and informative content, mortgage professionals can position themselves as industry experts, attracting and engaging their target audience. You can share this content on social media and through email marketing to reach more people and get more leads.

Mortgage professionals can grow their business and reach more borrowers by using lead generation opportunities. They should implement a comprehensive strategy.

Relationship Building

Building relationships is important in the mortgage industry. It helps create trust and keep borrowers happy. Mortgage professionals need organized contact management to nurture leads and maintain relationships with prospects. By utilizing mortgage software, professionals can stay connected with borrowers and track their interests and preferences, allowing for personalized and targeted communication.

Consistent follow-up is another key aspect of relationship building in the mortgage industry. Following up with prospects not only demonstrates attentiveness but also keeps you top-of-mind throughout their decision-making process. Mortgage software automates follow-up processes, so no opportunity is missed.

Moreover, mortgage software offers additional benefits for relationship building. It enables professionals to identify new prospects within their existing borrower database, uncovering potential opportunities for referrals or cross-selling. Professionals can save time and improve customer experience by using mortgage software features.

In summary, relationship building is a fundamental aspect of success in the mortgage industry. Professionals can build valuable relationships by staying connected with borrowers and tracking their interests. They achieve this through organized contact management, consistent follow-up, and mortgage software. This helps them identify new prospects and maintain lasting connections.

Frequently Asked Questions

What should be included in a professional website?

A professional website should have a clean design, easy navigation, and relevant content. It should also include essential pages like Home, About Us, Services, Contact, and a Blog or News section. Additionally, contact information, social media links, and a privacy policy are crucial.

What makes a good professional services website?

A good professional services website should have a clear description of services offered, testimonials, a portfolio of past work, and a strong call to action. It should be user-friendly, mobile-responsive, and have a professional, trustworthy design.

How do you know if a website looks professional?

A professional-looking website has a cohesive color scheme, high-quality images, legible fonts, and a well-organized layout. It should load quickly, be easy to navigate, and be free of errors like broken links or misspellings.

How many pages should a good website have?

The number of pages a good website should have can vary depending on its purpose. However, at a minimum, it should have a home page, a services or products page, an about us page, and a contact page. More complex sites may have many additional pages covering a range of topics.

Conclusion

To sum up, a well-designed mortgage website is essential to creating a unique brand in a competitive market. Mortgage professionals use their expertise, values, and deals to attract borrowers. A mortgage website can improve customer satisfaction and help mortgage professionals succeed. It does this by having user-friendly design, interesting content, and helpful tools.