People want to be able to do their own research on everything these days. The…

A careful budget must be created before investing in a mortgage website to assure its functioning and viability. Comprehending the various expenses associated with it facilitates the matching of your spending plan with your goals, guaranteeing a smooth journey towards a strong digital footprint.

What is a Mortgage Website?

Winning Every New Loan Requires A Job Interview.

Your Mortgage Website is your Digital Resume.

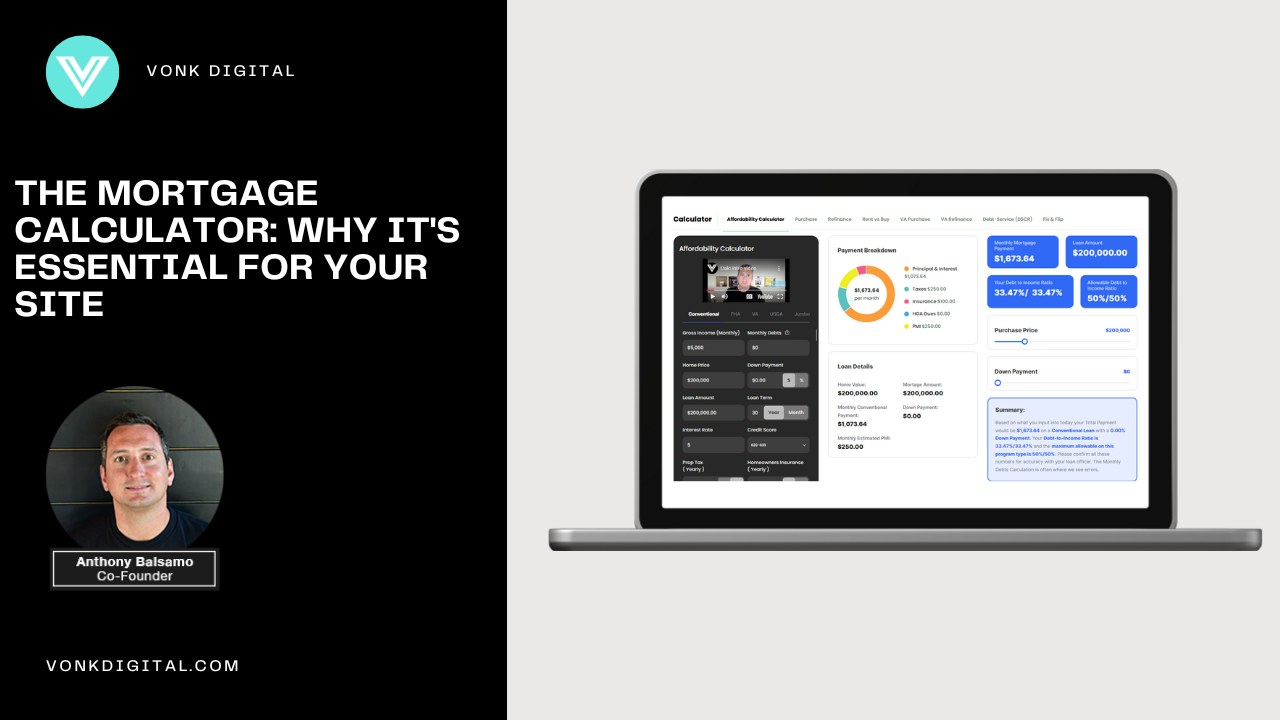

A mortgage website is essential for mortgage professionals who want to attract new borrowers online. It serves as a platform to highlight products, offer practical information, and generate leads. A well-designed mortgage website can show professionalism, knowledge, and trust to borrowers quickly. These websites frequently have tools like loan application forms, mortgage calculators, educational articles, and contact details. To stay competitive, it’s important to have a mortgage website since more people use digital platforms. To make sure it stays within your budget, it’s crucial to comprehend the expenses related to creating and managing a mortgage website. Understanding all of the relevant elements and factors will help you make an informed choice that supports your financial objectives.

Typical Features on a Mortgage Site

To have a successful mortgage website, certain important features are necessary. These features can vary depending on whether you choose a custom mortgage website or a turn-key solution that is “cusomtizable.” Here are some of the key differences between the two:

- Custom Mortgage Websites: These websites offer unique designs tailored to your specific business needs. You can customize your website’s design, layout, and functionality to make it unique. Custom mortgage websites also offer advanced features such as integrated loan calculators, lead capture forms, and mortgage rate tables. This level of customization allows you to create a website that stands out from the competition and reflects your brand identity. The main issue with a going with a custom website is cost, ongoing maintenance, time, and mortgage specific tools. when building a custom you may find yourself worlking with a company that is great at web developement but have no idea about the mortgage industry. in this case you become the defacto copywriter. Also it is expensive to develop mortgage industry specific tools such as calculators, an application that converts to a Mismo format, and even coming upw ith educational content. You may be stuck using free or paid addons from around the web to get the tools you need. Also, with company’s that focus on custom builds they pften leave the ongoing maintenance to you after the project is done. Think of this option more as a contractor that finshes the job and moves on. Then you are left to make sure nothing breaks, everythin stayed updated, and trouble shoot issues.

- Quick-Launch Themes: Quick-launch themes provide ready-made templates that can be easily set up and launched. If you want to create your mortgage website quickly, these themes have pre-designed layouts and features. While they may not offer the same level of customization as custom mortgage websites, quick-launch themes are often cost-effective and user-friendly. you tend to get what you pay for here. And in today’s digital first world having a quick half-baked online presence my be sendnig the wrong message to your prospects.

- Option 3 (This is where Vonk Digital comes in): What if you could have your cake and eat it too. You can get a high-end mobile optimized website platform that is modern, has all the tools and content you need already, and is gives you the ability to customize everything? This option allows you to have a support team to help with design changes, a team to handle any issues id they arise, without sacrificing control as you also get a backoffice admin portal. Now you can get basically a custom site “IE customizable” at a theme price with a real team behind you.

In addition to the above, our mortgage website solutions offer twelve unique designs to choose from. Each design comes with its own set of customization options, allowing you to personalize colors, fonts, and images to align with your branding.

You can pick a custom mortgage website or a quick-launch theme. Both options have tools for displaying loan content, updating the website, and engaging with borrowers. But you can also have custom quality and control at a fractio of the cost. Consider your specific needs and budget to determine which solution is best for your mortgage business.

Main Mortgage Website Expenses

When it comes to budgeting for a mortgage website, it’s important to have a clear understanding of the main expenses involved. The cost can vary based on your business’s specific needs. Consider these key factors. You will need to pay for the initial setup, ongoing maintenance, updates, hosting, and any extra features you want. To plan and budget for your mortgage website, understand these expenses. This will help ensure that your online presence is professional, user-friendly, and effective for your mortgage business.

Initial Website Design & Setup

There are a few choices to think about when it comes to a mortgage website’s initial setup and design. A quick-launch mortgage website design is the first choice; it provides a pre-made template that you can modify to suit your needs. This option is usually affordable and easy to set up with little time or effort.

You can choose a custom mortgage website design to create a unique website for your brand. This option can be more time-consuming and requires professional web design expertise, but it gives you more flexibility and control over the functionality and design elements of your website.

An alternative is to use a website-building platform to build your website from the ground up using a DIY website design. Although it is the most economical choice, it calls for a substantial investment of time and energy in addition to some technical know-how.

Every choice has advantages and disadvantages. While quick-launch mortgage website designs are convenient and reasonably priced, they might not have the same level of customization and distinctive look as custom designs. Although custom designs can be more costly and time-consuming, they offer a polished and customized appearance. Although do-it-yourself website designs are less expensive and more controllable, they might not be as professionally done and may need constant content management.

Depending on the route selected, there may be differences in the initial setup and design costs for websites. Mortgage websites designed for quick launches usually have one-time setup fees plus extra charges for customizations. The complexity of the design and the level of experience of the professional web designer can affect the cost of custom designs. Usually, the only expense associated with DIY website designs is the website-building platform. While selecting the ideal solution for your mortgage website, it’s critical to take both the initial and continuing costs into account.

Domain Name

When it comes to setting up your mortgage website, one important aspect to consider is your domain name. A domain name serves as the address for your website, making it crucial for potential borrowers to find you online.

Registering a domain name is a straightforward process. You can choose a domain registrar, such as GoDaddy or Namecheap, and check if your desired domain name is available. The cost of registering a domain name typically ranges from $12 to $60 per year, depending on the registrar you choose.

It’s important to note that while some premium domains may cost more, there are also options available for under $60. Premium domains are typically shorter and easier to remember, which can be beneficial for your mortgage website. However, if budget is a concern, there are plenty of affordable options that can still effectively represent your brand.

To build your mortgage website, you must register a domain name. It’s essential. Costs can vary depending on the registrar and whether you choose a premium domain. It’s important to carefully consider your budget and branding strategy when selecting your domain name.

Hosting

Creating a mortgage website costs more than just registering a domain. One important cost to factor in is hosting. Hosting is a separate fee from the domain and is necessary for visitors to access your website.

To find the best web hosting service for your mortgage website, there are several reliable options available.

The cost of hosting a mortgage website can range from $100 to $500 per year, depending on the hosting service and plan you choose. It’s important to invest in a robust hosting plan, particularly if your website expects high traffic. A reliable hosting service ensures that your website remains accessible and responsive to visitors even during peak times.

By considering hosting expenses as a separate fee, you can budget more effectively for your mortgage website. Allocating funds specifically for hosting allows you to invest in a dependable service that will support the needs of your online presence.

SSL Certificate

An SSL certificate is essential for a mortgage website as it plays a crucial role in ensuring website security and building trust with users.

One of the key functions of an SSL certificate is to encrypt the data that is exchanged between the website and its users. This encryption keeps sensitive data safe by offering a secure payment method. It prevents unauthorized parties from accessing credit card numbers or personal information. With an SSL certificate, mortgage professionals can assure their borrowers that their information is safe and that they are committed to protecting their privacy.

In addition to boosting website security, an SSL certificate also has a significant impact on user trust. When visitors see the padlock icon or “https” in the URL, they know the website is secure. This gives them confidence in the legitimacy and reliability of the mortgage professional’s website, increasing the credibility of their services.

You can choose from various SSL certificates, which offer different levels of security and assurance. Prices for SSL certificates can vary based on the certificate type, the level of validation, and the additional features offered by the SSL service provider.

Some popular SSL service providers include GlobalSign, Comodo, DigiCert, and Symantec. Starting prices for SSL certificates can range from $20 to $100 per year, depending on the provider and the specific certificate you choose.

Investing in an SSL certificate is important for secure and trustworthy mortgage websites. It protects sensitive information and improves user experience.

Additional Expenses to Consider

Securing an SSL certificate is not the only step in the process of building a mortgage website. It’s crucial to take into account any potential additional costs in order to give mortgage professionals a comprehensive understanding of the extent of their investment. These costs may differ based on the particular needs and objectives of the website. Mortgage professionals will be able to make more informed decisions and budget appropriately if they are aware of the costs associated with custom designs, content management systems, professional web design services, and website building platforms. In this post, we’ll look at a few extra costs that might come up when building a mortgage website and discuss how they might affect final costs. By knowing these costs, mortgage professionals can plan their budget and ensure online success.

Additional Software and Plugins

When creating a mortgage website, think about the extra software and plugins that can improve how it works. Plugins can do many things, like testimonials and contact forms, or newsletter subscriptions. However, it’s crucial to use these plugins sparingly to avoid slowing down your website’s loading speed and negatively impacting the user experience and SEO.

There are both free and paid versions of plugins available for mortgage websites. While free plugins can be a cost-effective option, they may not offer as many features or customization options as their paid counterparts. To keep your website safe and running smoothly, make sure to update and remove unused plugins.

When considering additional software and plugins for your mortgage website, remember to prioritize user experience and loading speed. A website that loads quickly and offers a seamless browsing experience will not only keep visitors engaged but also improve your search engine rankings. Choose your plugins carefully and adjust their settings to balance functionality and performance.

Marketing Services

To promote a mortgage website, you can use different marketing services to get more visitors and increase visibility. A good strategy is SEO, which improves your website’s ranking on search engines. By targeting relevant keywords and improving website structure, SEO can help attract more organic traffic.

Another popular strategy is pay-per-click (PPC) advertising. With PPC, you can create targeted ads that appear on search engines and other websites, only paying when someone clicks on your ad. This allows for better control over your budget and can drive immediate traffic to your mortgage website.

Social media marketing is another powerful tool for mortgage website promotion. By creating engaging content and targeting specific demographics, you can reach and engage with potential borrowers on platforms like Facebook, Instagram, and LinkedIn.

Email marketing is also effective for promoting a mortgage website. By building an email list and sending regular updates, tips, and offers, you can stay top of mind with prospects and nurture relationships with past borrowers.

Content marketing is crucial for establishing credibility and attracting organic traffic. By creating informative and valuable content, such as blog posts and educational resources, you can position yourself as an industry expert and drive traffic to your mortgage website.

Mortgage professionals can use these marketing services to promote their websites and reach their goals.

Frequently Asked Mortgage Website Budgeting Questions

What are the expenses for creating a website?

Creating a website entails several expenses, such as domain registration, hosting, design and development, and possibly content creation. Additionally, there may be costs for plugins, themes, or any custom functionality required for the website’s specific needs.

How much should it cost to manage a website?

Managing a website’s cost can vary based on the website’s size and complexity. Expenses may include hosting fees, domain renewals, content updates, security measures, and regular maintenance, which could range from a few dollars to several hundred dollars monthly.

How much should I pay for website development?

Website development costs can vary widely, from a few hundred to tens of thousands of dollars, depending on the website’s complexity, design aesthetics, functionality requirements, and the developer or agency’s rates.

How many hours does it take to build a website?

The time to build a website can range from a few hours for simple sites to several weeks or even months for more complex or custom-designed sites. The timeline can be influenced by the project’s scope, revisions, and the efficiency of the development team.

Conclusion

When you buy a mortgage website, there are many costs to consider. These include setting up and designing the site, hosting it, getting SSL certification, and registering the domain. Adding plugins and software can increase costs. Different marketing techniques may also add to expenses. To align their budget with their vision and support their business goals, mortgage professionals need to understand these cost factors. This will also help them establish a strong online presence.